Cybersecurity Risks in Fintech: A Comprehensive Guide To Protect Your Fintech App

In the wake of digital wallets and advanced payment systems, the fintech sector has witnessed an unprecedented surge. This evolution, driven by technological advancements, has paved the way for companies to elevate the client experience to new heights. Yet, this very growth has become a beacon for cyber malefactors.

Amidst this digital renaissance, financial institutions find themselves grappling with the looming shadow of data breaches. This piece delves deep into the pivotal security challenges intrinsic to fintech web and application architectures. Furthermore, it underscores best practices for fortification, sheds light on pertinent industry regulations, and offers insights into emerging trends in the realm of fintech security.

The Imperative of Security in Fintech: Beyond the Basics

Banking has always attracted fraudsters, whether the financial transaction is conducted at a bank or online. Important information can also be jeopardized by simple human errors or technical issues. Whatever the cause of the data leak can destroy your company’s reputation in the blink of an eye. It causes irreparable financial harm and the loss of intellectual property.

- Cybercrime Evolution: Cybercrime has become more organized than ever. The rise of Ransomware-as-a-Service (RaaS), Hackers-as-a-Service (HaaS), and Access-as-a-Service (AaaS) has made cyber-attacks more accessible and sophisticated. – Source

- The average cost of a data breach in the U.S. in 2022 is $9.44 million. The global average cost per data breach was $4.35 million in 2022. – Statista

- The cost of cybercrime is predicted to hit $8 trillion in 2023 and will grow to $10.5 trillion by 2025 – Cybersecurity Ventures

- It was predicted that a business fell victim to a ransomware attack every 11 seconds in 2021. The frequency may rise to every 2 seconds by 2031. – Cybersecurity Ventures

- 70% of small businesses reported experiencing a cyber attack in 2021. – Keeper Security

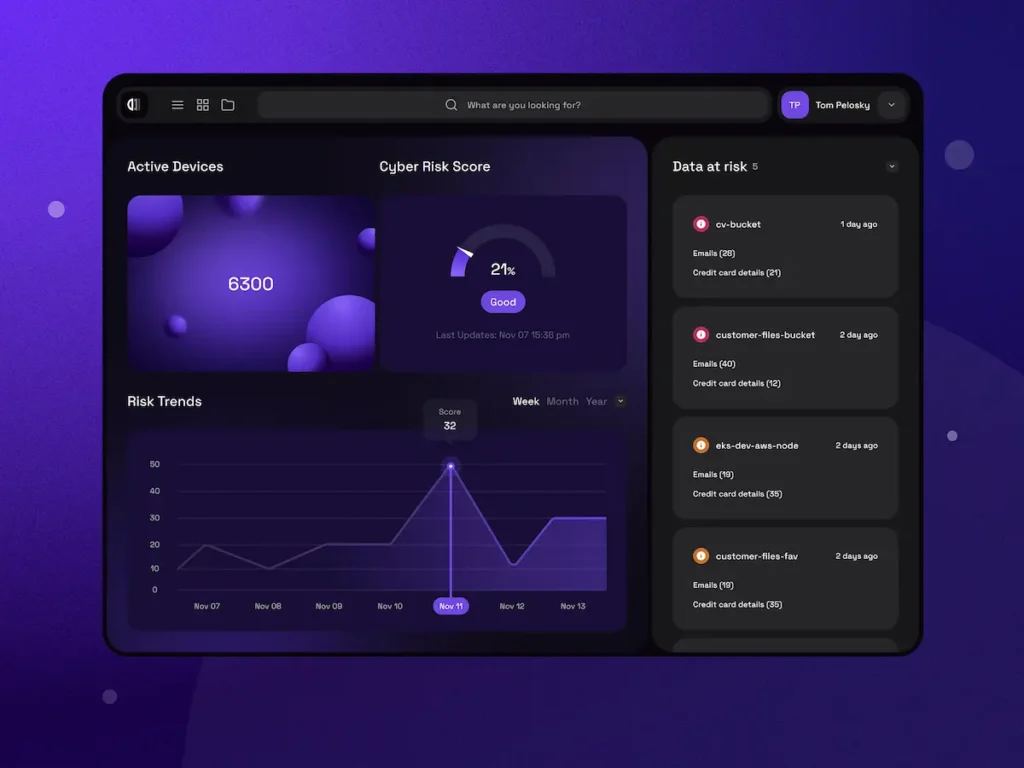

1. Cybersecurity Challenges in Fintech

The fintech sector, with its rapid technological advancements, is not immune to the myriad of cybersecurity threats that loom in the digital realm. Here’s a detailed breakdown of the potential risks and the nuances associated with each:

Malware Attacks

- Evolutionary Threat: Malware, in its various forms, remains at the forefront of digital threats. Its adaptability and evolution make it a formidable challenge.

- Infiltration Techniques: Malware can seep into systems through diverse channels, including but not limited to email attachments, third-party software installations, deceptive websites, and intrusive pop-up ads.

- Distinctive Nature: What sets malware apart from other digital threats is its ability to constantly morph, making detection and eradication a moving target for cybersecurity professionals.

Identity Theft

- Authentication Protocols: Financial institutions, in their bid to ensure robust security, deploy multiple authentication methods. These range from biometrics and one-time payment codes to traditional password systems.

- Duplication Dangers: Despite their efficacy, these authentication techniques are not foolproof. Skilled hackers can replicate or bypass them, leading to unauthorized access and potential financial losses.

- Layered Defense: To bolster security, it’s imperative for banks and financial institutions (FIs) to implement multi-factor authentication, diversifying the principles upon which each layer is based.

Money Laundering Risks

- Cryptocurrency Concerns: The surge in cryptocurrency popularity has ushered in a new set of challenges. Their anonymous and decentralized nature makes them an attractive avenue for illicit activities.

- Anonymity Issues: The very features that make cryptocurrencies appealing – anonymity and decentralization – also make them susceptible to misuse, especially in money laundering schemes where tracing the origins becomes a Herculean task.

Data Leakage

- Information Overload: Fintech firms handle a staggering amount of sensitive data, encompassing personal details, financial records, and intricate transaction histories.

- Advanced Threat Landscape: As cybercriminals refine their tactics, ensuring watertight digital security becomes an uphill battle for these firms, escalating the risk of data breaches.

- Guarding the Vault: It’s crucial for fintech entities to invest in state-of-the-art security infrastructure and continually update their defense mechanisms to stay ahead of potential threats.

Third-party Risks

- Reliance on External Tools: Financial institutions often integrate third-party applications into their operations, aiming to enhance functionality and user experience.

- Access Vulnerabilities: This external integration can be a double-edged sword. Malicious actors can exploit these third-party tools to masquerade as legitimate users, thereby gaining unauthorized access.

- Vetting and Verification: To mitigate these risks, financial entities must exercise due diligence, rigorously vetting third-party services and ensuring they adhere to the highest security standards.

A Dedicated Team might be the best solution for speed and precision in your case. Get in touch with us and we’ll help you choose the best IT outsourcing model based on your business needs and requirements.

2. A Deep Dive Into The Best Practices For Fintech Security

In the digital age, fintech platforms are revolutionizing the financial sector. However, with great innovation comes great responsibility, especially in terms of security. Here’s an analytical breakdown of the best practices for fintech security:

Regular Data Backup

- The Necessity: Data loss isn’t just a result of cyber threats. Human errors, system malfunctions, and unforeseen events can also lead to data compromise.

- Strategic Approach: Regularly backing up data, especially every six months, ensures that the most recent and relevant information is preserved, minimizing potential disruptions.

Data Storage Encryption

- The Shield: Encryption acts as a protective shield, ensuring data remains confidential and inaccessible to unauthorized entities.

- Beyond Protection: While encryption primarily safeguards data, it also acts as a deterrent, discouraging potential breaches.

Role-based Access Control

- Strategic Segregation: Assigning access based on roles isn’t about distrust; it’s about strategic data management.

- Efficiency Boost: By streamlining access, companies can enhance efficiency, ensuring individuals have the exact tools they need without unnecessary administrative clutter.

Unit Tests for Access Control

- Precision is Key: In the realm of fintech, there’s no room for error. Unit testing ensures that every user sees precisely what they should, no more, no less.

- Proactive Approach: Regular unit testing acts as a proactive measure, identifying potential discrepancies before they become significant issues.

Vulnerabilities Monitoring for Third-parties

- Third-party Threats: While third-party software can enhance functionality, they can also introduce vulnerabilities.

- Continuous Vigilance: Regular monitoring and evaluation of third-party tools can identify and rectify potential weak points, ensuring the overall system remains robust.

Encryption Key Management

- Guarding the Keys: Just as a key can unlock a treasure, encryption keys can unlock data. Proper management ensures these keys remain in the right hands.

- Centralized Control: Centralized key management systems ensure that access, distribution, and storage of keys are streamlined and secure.

Single Entry Point Guarantee

- Controlled Access: Just as banks have secure entrances, fintech platforms should have a single, monitored entry point.

- Rapid Response: A single entry point allows for quicker detection and response to unauthorized access, ensuring potential breaches are nipped in the bud.

Metadata Tracking

- Digital Footprints: Tracking IP addresses and device IDs can provide insights into user behavior and potential security threats.

- Balancing Act: While tracking is essential, it’s equally crucial to ensure that the data collected respects user privacy and adheres to regulatory standards.

Multi-factor Authentication (MFA)

- Layered Defense: MFA introduces multiple layers of verification, making unauthorized access considerably more challenging.

- User-friendly Security: Modern MFA solutions, such as biometric verification or one-time codes, offer robust security without compromising user experience.

Continuous Security Training

- Human Element: Often, the weakest link in security isn’t technology but people. Regular training ensures that all team members are aware of the latest threats and best practices.

- Adaptive Learning: As threats evolve, so should training. Continuous updates and refresher courses ensure that the team’s knowledge remains current and comprehensive.

In conclusion, as fintech platforms continue to evolve and expand their offerings, maintaining robust security practices is not just recommended — it’s imperative. Adopting and regularly updating these best practices can ensure that fintech platforms remain trusted and secure in an ever-changing digital landscape.

3. Overview of Key Fintech Compliance Regulations and Security Technologies

Navigating the complex landscape of compliance regulations is a critical task for fintech companies. Below is an analytical breakdown of the most pivotal regulations and technologies that are shaping the fintech industry’s approach to security and compliance.

a. Regulatory Frameworks in Fintech

PCI DSS (Payment Card Industry Data Security Standard)

- Scope: Targets companies that process credit card transactions.

- Compliance Levels: Divided into four levels based on annual transaction volume.

- Objective: Aims to safeguard against fraudulent activities online by enforcing stringent data security measures.

ISO/IEC 27001 (Information Security Management System)

- Scope: Governs the management of digital information security.

- Requirements: Specifies the criteria for a secure information management system.

- Objective: Ensures that organizations have effectively managed their cybersecurity risks.

GDPR (General Data Protection Regulation)

- Scope: Regulates the handling of personal data of EU residents.

- Global Reach: Applicable to any organization worldwide that processes EU residents’ data.

- Objective: To protect the privacy and security of EU citizens’ personal information.

PSD2 (Payment Services Directive 2)

- Scope: Covers electronic payment services within the EU.

- Consumer Consent: Mandates user approval for sharing data with third-party providers.

- Objective: Enhances security through strong consumer authentication for online payments.

eIDAS (Electronic Identification, Authentication, and Trust Services)

- Scope: Standardizes the legal framework for secure cross-border electronic transactions.

- Audience: Targets enterprises, citizens, and governmental agencies.

- Objective: To bolster the security of electronic transactions across borders.

FCA (Financial Conduct Authority)

- Scope: UK-based regulatory body focused on consumer and financial market protection.

- Registration: Mandatory for all fintech service providers operating in the UK.

- Objective: To foster healthy competition and safeguard consumer interests.

b. Cutting-Edge Technologies for Fintech Security

AI for Fraud Detection

- Data Analysis: Utilizes AI and Machine Learning to analyze both customer and company data.

- Proactivity: Identifies potential security threats before they escalate.

- Objective: To enhance cybersecurity measures through advanced data analytics.

Blockchain Technology

- Decentralization: Operates on a decentralized network for enhanced security.

- Data Integrity: Employs cryptographic methods to ensure data transparency and integrity.

- Objective: To provide a more secure and reliable data transaction environment.

Multi-Cloud Storage Solutions

- Data Management: Facilitates efficient handling of large data volumes.

- Security: Offers a more secure alternative to single public cloud systems.

- Objective: To improve data transparency and cost-effectiveness.

Regulatory Technologies (RegTech)

- Scope: Addresses the growing list of regulatory responsibilities in the financial sector.

- Capabilities: Utilizes big data analytics for real-time monitoring and reporting.

- Objective: To simplify the compliance process and make it more efficient.

Conclusion

Security remains the cornerstone of fintech operations, which are increasingly susceptible to criminal activities. Therefore, it is imperative to integrate security measures throughout all operational phases—from partner selection to product development and testing. Moreover, these measures must be in compliance with existing regulations and agile enough to adapt to emerging threats. By considering the above-mentioned regulatory frameworks and technologies, fintech companies can proactively secure their operations and mitigate future risks.

From Tech Consulting, End-to-End Product Development to IT Outsourcing Services! Since 2009, Savvycom has been harnessing the power of Digital Technologies that support business’ growth across the variety of industries. We can help you to build high-quality software solutions and products as well as deliver a wide range of related professional services.

Savvycom is right where you need. Contact us now for further consultation:

- Phone: +84 24 3202 9222

- Hotline: +84 352 287 866 (VN)

- Email: [email protected]

How Do You Secure A Fintech App?

Enhancing security in fintech applications is pivotal to safeguarding sensitive financial data and ensuring a robust user experience. Here are ten security solutions that fintech applications can employ:

- Security Code and Architecture: Implementing a robust security code and architecture to fortify the application against potential vulnerabilities.

- Code Obfuscation to Prevent Cloning: Employing code obfuscation techniques to deter unauthorized cloning attempts and protect proprietary code.

- AI and ML for Transaction Monitoring: Leveraging Artificial Intelligence (AI) and Machine Learning (ML) algorithms to monitor user transactions, detect anomalies, and identify potential fraudulent activities.

- Secure Identification, Authentication, and Authorization Processes: Establishing secure and multifactor authentication processes to ensure only authorized users can access sensitive financial information.

- Tokenization for Data Protection: Utilizing tokenization to replace sensitive data with unique tokens, reducing the risk of unauthorized access and ensuring secure data transmission.

- Securing APIs and Cloud Servers: Implementing robust security protocols for Application Programming Interfaces (APIs) and securing data stored in cloud servers to prevent unauthorized access.

- Safety-Oriented Testing: Conducting comprehensive security testing, including penetration testing and vulnerability assessments, to identify and address potential security gaps.

- Ensuring Security Measures in Daily Workflows: Integrating security measures seamlessly into daily workflows to create a security-conscious environment for users and employees.

- Comprehensive Mobile Encryption Policy: Establishing a comprehensive mobile encryption policy to protect data at rest and in transit, enhancing overall mobile security.

- Hiring the Right Development Team: Assembling a skilled and experienced development team with expertise in fintech security to ensure the application is built with the highest standards of security in mind.

What Are The Challenges Of Fintech Cybersecurity?

Addressing cybersecurity risks is paramount in the fintech industry to protect sensitive financial data and maintain the trust of users. Here are the top 10 cybersecurity risks and challenges faced by fintech:

- Data Breaches: Unauthorized access or disclosure of sensitive customer information, financial data, or proprietary business data.

- Phishing Attacks: Deceptive attempts to acquire sensitive information such as usernames, passwords, and financial details by posing as a trustworthy entity.

- Insider Threats: Risks arising from employees or other trusted individuals with access to sensitive information intentionally or unintentionally causing harm or data breaches.

- DDoS Attacks: Distributed Denial of Service attacks that overwhelm systems with traffic, leading to service disruption and potential data exposure.

-

Regulatory Compliance: Challenges associated with ensuring compliance with evolving and stringent financial regulations to protect against legal and financial repercussions.

-

Mobile Security Risks: Vulnerabilities in mobile applications and devices, including insecure networks, mobile malware, and device theft, which can compromise financial data.

-

Third-Party Risks: Potential security vulnerabilities introduced by external vendors, partners, or service providers that have access to the fintech ecosystem.

-

API Vulnerabilities: Weaknesses in Application Programming Interfaces that may be exploited by attackers to gain unauthorized access or manipulate data.

-

Ransomware Attacks: Malicious software that encrypts data, rendering it inaccessible until a ransom is paid, posing a significant threat to fintech operations.

-

Artificial Intelligence and Machine Learning Risks: Risks associated with the use of AI and ML in fintech, including biased algorithms, adversarial attacks, and potential exploitation of AI-based systems.