10 Best Programming Languages For Banking, Finance & FinTech

In contemporary times, the FinTech sector plays a pivotal role in effectively managing financial transactions. These financial technologies facilitate enhanced financial services and efficient expense management. It is imperative to grasp the intricacies of crafting a fitting FinTech application with the appropriate technology stack, whether you are currently engaged in the financial sector or contemplating embarking on FinTech software development. This insight holds particular relevance for a software development company aiming to navigate the complexities of FinTech application development.

This article will help you learn more about programming for finance and list out the 10 most popular banking programming languages.

Top 10 banking programming languages

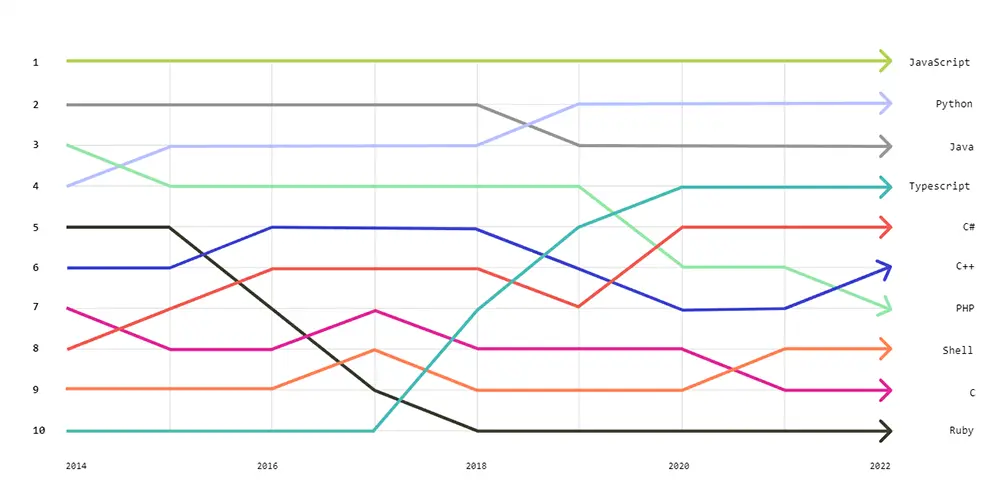

Nowadays, programming is essential in the banking sector. To develop fintech websites, we recommend the top 10 programming languages related to finance. It’s not surprising that a GitHub survey discovered that these programming languages were highly correlated with the most frequently used technologies by developers in 2024.

Top Languages Used In 2022 (GitHub)

1. Python

Python is one of the most user-friendly and versatile programming languages for financial applications. This programming language is popular among developers because of its readability and adaptability to a wide range of applications, regardless of the project’s scalability.

Some benefits that developers have while coding with Python are:

- Cross-platform

- A vast selection of libraries and frameworks

- Clean and easy-to-use syntax

- Experience in various fields, including the banking and financial service, data analytics, and technology sectors

- Simple programming language for new beginners

- Effective performance of financial algorithms

- Easy to scale

Also, Python works well in the financial industry because it can handle mathematical computations. Python’s use in finance is anticipated to grow due to the banking sector’s and other quasi-financial institutions’ growing need for technological cooperation.

Examples: Robinhood; Stripe; Zopa; Venmo.

2. Java

Java is another top-ranked finance coding language due to its cross-industry popularity since it debuted in 1995 as the fundamental component of the Sun Microsystems Java platform. This coding language is user-friendly, object-oriented, and capable of handling large volumes of data. Java has been used for almost 25 years and remains the preferred choice even when new and powerful programming languages arise.

The advantages of Java include:

- Can run on multiple platforms and fields

- Adopt robust security

- Offer great versatility – can work well with the latest technologies like cloud computing, AI, etc.

- Have rich standard API

-

Provide continual updates

- Simple to maintain

- Extensive frameworks, libraries, communities, and foundations

Java is preferable when developing front-end applications because finance and FinTech demand a highly secure system. For instance, Java is still the preferred coding language in the banking sector because it is secure, reliable, and capable of processing enormous volumes of data.

3. JavaScript

One of the best programming languages is JavaScript, which is utilized to create web pages and front-end technologies. Developers can utilize JavaScript to make your website look more interesting and interactive, improving user experience.

There are numerous advantages to employing JavaScript for your financial product, including the following:

- Highly secure

- Offer exceptional portability, scalability, and compatibility

- Cross-platform

- Process & analyze large amounts of data efficiently

4. Scala

Scala is a general-purpose programming language. This coding language was developed to collaborate closely with Java and address its inherent problems. Hence, Scala is utilized for various tasks such as web development, big data processing, and distributed systems.

Because Scala code is easy to read, programmers can build complicated systems quickly. Additionally, Scala interfaces with Java smoothly, enabling programmers to include pre-existing Java libraries in their projects. The type structure of the language also aids programmers in avoiding typical programming blunders.

Some other advantages that make Scala a good choice for the fintech industry are:

- Excel in operation processing

- Offer safety feature

- Provide a robust set of libraries

Have a Project Idea in Mind?

Get in touch with Savvycom’s experts for a free consultation. We’ll help you decide on next steps, explain how the development process is organized, and provide you with a free project estimate.

5. C++

Even though C/C++ was developed in the late 1970s, fintech companies that prioritize speed still choose it as their preferred programming language. C++ is differentiated by its unique compiler and ability to create complex, multi-level systems.

The programming language used to create applications is essential for security and reliability. For this reason, C++ is a preferred language in the financial industry as it strictly enforces type compliance and reduces the chance of errors. It is also helpful for monitoring and minimizing different types of risks, including market, credit, and operational risks. With C++, developers can create dependable systems that analyze and model large datasets to identify and proactively address potential threats.

When coding a fintech app with C++, this language offers a specific set of values:

- Improve performance, scalability, and reliability of the apps

- Allow strong memory management

- Can handle large datasets and executes trades quickly

- Provide robust security features

- Suitable for building financial apps with blockchain

6. C#

C# is a successor to C++ and continues to have a sizable presence in both Fintech (the fourth-ranked language) and finance (the fifth-ranked), according to HackerRank. This high-level, object-oriented programming language creates dynamic apps operating in the Microsoft and .NET ecosystem.

Developers can gain additional benefits from using C#, such as:

- Greater security

- Higher scalability with a managed memory system

- Reduce latency for a more reliable performance

- Is supported across all platforms, including Windows, Linux, and Mac

- Have a strong set of libraries and frameworks for working with data, including LINQ

7. ReactJS

ReactJS is an open-source JavaScript library developed by the Facebook team to facilitate the development of frontend or user interface components for apps. It was introduced in 2014 and has already surpassed other technologies as the go-to choice for developing websites and mobile applications for almost all market segments.

React JS can be used for server-side rendering, aside from front-end development, allowing for faster website loading speeds. A financial website with a large amount of data may require React JS for the loading process.

Here are some reasons React JS is essential while developing financial software:

- Work cross-platform

- Offer extensive testing utilities, such as Jest and React Testing Library

- Secure the quality, reliability, and scalability of fintech apps

- Automate tedious or repetitive tasks

- Allow the creation of reusable elements for more efficient workflows

- Have robust security features

- Can add new libraries, making it easier to integrate new technologies into the apps

Looking For a Trusted Tech Partner?

We’ll help you decide on next steps, explain how the development process is organized, and provide you with a free project estimate.

8. Ruby

Because of its effectiveness and simplicity, digital finance organizations use Ruby in conjunction with the Ruby on Rails framework. Ruby is also preferred by developers over other programming languages due to its simplicity, which helps save time and money, and the security features that are already built in.

Ruby has some programming traits that are relevant to the financial industry, most notably speed, security, and flexibility. Ruby is a programming language used to develop a range of financial or digital banking solutions, including payment systems and dashboards.

The key benefits Ruby can add when developing a financial app are listed below:

- Automate and streamline processes

- Build dashboard components

- Offer libraries and APIs that facilitate integration with popular payment gateways

- Let developers create effective backtesting platforms for quantitative analysis

9. Kotlin

As a relatively new technology for its Android platform, Kotlin has been dubbed a “first-class language” by Google. Kotlin is a language that many financial projects cling to, partly because of its design, which prioritizes mobile devices.

Due to its unique properties, Kotlin is widely used in various industries, particularly financial technology. The financial industry has taken notice of this fact.

So, what are those particular advantages that Kotlin has over other languages? Let’s see.

- Make coding less complex compared to Java

- Guarantee high performance

- Have a null safety feature to prevent common programming errors

10. SQL

Compared to the other programming languages described above, SQL is unique. In particular, developers will not develop a website or application directly using SQL. Since SQL leverages databases to their full potential, it serves as a vital tool for those working in the BFSI sector.

Financial institutions generate enormous amounts of data that need to be thoroughly analyzed. Professionals from a variety of industries, including business, marketing, sales, and finance, understand how important practical data analysis is to success. SQL is a vital instrument in this process that serves as a successful route. This programming language is used in statistical modeling, incorporated into data processing systems, and has increased in value among financial analysts.

How to choose the correct programming language for your project

Choosing the right programming language for your project is an important decision that can impact the success and efficiency of your development process. Here are some steps to help you choose the correct programming language for your project:

- Understand your project requirements: Begin by having a clear understanding of your project’s objectives, scope, and requirements. Consider the nature of the project, the problem you’re trying to solve, the target audience, and any technical constraints or preferences.

- Consider your team’s skills and expertise: Evaluate the skills and expertise of your development team. Choosing a programming language that your team is familiar with can help improve productivity and reduce the learning curve. If you have a specific skill set in your team, leverage that expertise when making your decision.

- Assess the language ecosystem and community support: Evaluate the programming language’s ecosystem and community support. Consider factors such as the availability of libraries, frameworks, and tools that can assist in developing and maintaining your project. A robust ecosystem with active community support can save you time and effort during development.

- Performance and scalability requirements: Consider the performance and scalability requirements of your project. Some programming languages are better suited for high-performance computing, while others may excel in web development or data analysis. Research the performance characteristics of different languages and choose one that aligns with your project’s requirements.

- Time and budget constraints: Evaluate the time and budget constraints for your project. Some programming languages may require more development time or have higher licensing costs than others. Consider the availability of skilled developers and the cost of development tools when making your decision.

- Platform compatibility: Determine the platforms on which your project needs to run. Some languages are more suitable for specific platforms, such as mobile app development, web development, or desktop applications. Ensure that the programming language you choose is compatible with your target platforms.

- Future maintenance and support: Consider the long-term maintenance and support requirements of your project. Choose a programming language that has a stable and active community, ongoing updates, and a well-established track record. This ensures that you can easily find resources, address any issues, and keep your project up to date in the future.

- Evaluate alternatives: Don’t limit your options to a single programming language. Explore alternative languages that might be suitable for your project. Compare their features, advantages, and disadvantages to make an informed decision.

- Prototype and experiment: If you’re still unsure, consider building a small prototype or conducting some experiments using different programming languages. This can help you assess their suitability for your project and give you firsthand experience in working with them.

Takeaway

For activities like data analysis, algorithmic trading, risk management, and creating financial dashboards, payment systems, and blockchain applications, these programming languages offer the required tools and frameworks. They support experts in the BFSi industry and related fields to efficiently handle large amounts of data, automate processes, and finally make informed decisions.

When selecting a software development team, it is important to consider their familiarity with the relevant technology stack. At Savvycom, we have extensive experience in building financial and fintech solutions using the appropriate programming languages to ensure optimal software performance.

Savvycom – Your Trusted Tech Partner

From Tech Consulting, End-to-End Product Development to IT Outsourcing Services! Since 2009, Savvycom has always been the top 3 IT companies in Vietnam, harnessing the power of Digital Technologies that support business’ growth across the variety of industries. We possess the expertise to assist you in developing top-notch software solutions and products, along with providing an extensive array of associated professional services. This highlights our commitment to delivering excellence in software development as a service.

Savvycom is right where you need. Contact us now for further consultation:

- Phone: +84 24 3202 9222

- Hotline: +84 352 287 866 (VN)

- Email: [email protected]

What are the top features that a modern banking app should have?

Modern banking apps aim to provide convenient, secure, and feature-rich experiences to users. Here are some top features that a modern banking app should ideally have:

- User-friendly Interface: A modern banking app should have an intuitive and user-friendly interface that allows customers to navigate through different features and functionalities easily. It should provide a seamless and visually appealing user experience across various devices and screen sizes.

- Account Management: Users should be able to view their account balances, transaction history, and manage multiple accounts within the app. Features like fund transfers, bill payments, and the ability to set up recurring payments should be included.

- Mobile Payments: Integration with mobile payment services such as Apple Pay, Google Pay, or other digital wallets allows users to make secure payments directly from their banking app. It simplifies the payment process and enhances convenience for users.

- Notifications and Alerts: Real-time notifications and alerts play a crucial role in keeping users informed about their account activities, such as large transactions, account balance updates, or payment due dates. Customizable push notifications and in-app alerts help users stay updated and monitor their finances effectively.

- Personal Financial Management: Including features for budgeting, expense tracking, and goal setting enables users to manage their finances more effectively. The app can provide visualizations, spending analysis, and insights to help users make informed financial decisions.

- Security Features: Banking apps must prioritize security. Biometric authentication, such as fingerprint or facial recognition, along with strong encryption protocols, provide robust security for user data and transactions. Two-factor authentication (2FA) adds an extra layer of protection.

- Customer Support: Integration with customer support features like in-app chat, messaging, or the ability to schedule appointments with bank representatives helps users resolve queries or seek assistance within the app itself.

- Card Management: Users should have the ability to manage their debit or credit cards, including card activation, temporary card locks, transaction controls, and notifications for card-related activities.

- ATM and Branch Locator: An integrated map-based feature that helps users locate nearby ATMs, branches, or partner networks provides convenience and enhances the overall banking experience.

- Personalized Offers and Recommendations: Leveraging user data and analytics, modern banking apps can provide personalized offers, rewards, and recommendations tailored to individual users' financial needs and preferences.