FinTech App Development: Step-by-Step Guide with Types, Features, Costs

Fintech (financial technology) is one of today’s trendiest technological fields, people utilize fintech applications practically every day, from online shopping to mobile banking transactions.

The fintech sector is growing at an exponential rate, with total digital transaction value expected to reach $10.52 trillion by 2025. This is why many enterprises are investing in fintech app development. But it is not an easy job if you are not an expert.

This blog will guide you from start to finish how to develop a superb fintech app. Let’s get started.

1. Fintech Market Statistics

In recent years, the FinTech market has grown at an exponential rate, owing to a mix of technical breakthroughs, changing customer tastes, and the advent of digital-first financial services.

Let’s look at some of the main data and trends influencing the fintech landscape:

-

Global digital wallet spending will top $10 trillion by 2025.

-

The worldwide fintech industry’s revenue is expected to grow by 125.18 billion US dollars per year between 2023 and 2027.

- The investment value climbed in 2021, reaching over 239 billion US dollars.

2. Most Common Types Of FinTech App

Fintech app development provides many advantages. Looking at the market, you can design numerous types of financial apps. Let’s look at some of the most popular choices.

2.1. Digital Banking

Users can manage their bank accounts using digital banking apps instead of visiting a physical bank location. It provides the majority of the services given by a traditional physical bank, such as account opening, balance checking, funds transfer, payment processing, loans, and so on. These apps allow users with access to their bank accounts 24/7. Furthermore, regular app notifications keep consumers informed.

Here are a few digital banking platforms in the United States:

- Chime: a popular digital banking platform that offers a range of services, including checking and savings accounts, debit cards, and fee-free ATM access. It provides a user-friendly mobile app with features like early direct deposit, automatic savings, and real-time transaction alerts.

- Ally Bank: an online bank that provides a comprehensive suite of banking services, including checking and savings accounts, certificates of deposit (CDs), and home loans. It offers competitive interest rates, a user-friendly website, and 24/7 customer support.

- Varo Money: a mobile banking platform that offers online checking and savings accounts, as well as personal loans. It provides tools for budgeting and financial management, along with features like early direct deposit and fee-free ATM access through the Allpoint network.

- Capital One 360: the digital banking division of Capital One. It offers online checking and savings accounts, CDs, credit cards, and home loans. The platform provides a mobile app and a user-friendly website, along with features like mobile check deposit and bill pay.

- Simple: a digital banking platform that aims to make banking more intuitive and streamlined. It offers checking accounts, budgeting tools, goal setting features, and expense tracking. Simple provides a mobile app with a clean and user-friendly interface.

- Marcus by Goldman Sachs: Marcus by Goldman Sachs is an online banking platform that offers savings accounts, personal loans, and CDs. It provides competitive interest rates, no fees, and a user-friendly website. The platform is known for its straightforward and transparent approach to banking.

2.2. Investment & Trading

These investment apps offer a platform for fintech investment in a variety of financial assets, such as stocks, bonds, and mutual funds. They help eliminate the need for mediators and intermediaries, making investing accessible to everyone with just a few quick taps.

These apps come with various features that make trading stocks easy, including real-time account updates and market insights. With these apps, users can keep track of their investments and make informed decisions about the markets.

2.3. Mobile Payments & E-Wallets

FinTech apps have transformed electronic transactions through mobile devices, enabling secure and fast money transfers, digital payment management, and purchasing goods and services. This has led to innovative fintech solutions across various industries, allowing for cost-effective and real-time payment transfers.

These solutions provide a seamless payment experience for consumers and have disrupted traditional payment systems. With the prevalence of these apps, businesses are introducing more fintech solutions that make payment transfers even more cost-effective and efficient.

2.4. Financial Management & Personal Finance

Personal finance apps, or budgeting apps, help users manage their finances effectively. These apps come equipped with features such as budgeting tools, expense categorization, and financial goal-setting capabilities, providing users with a holistic understanding of their income-expense ratio and helping them plan their expenditures.

The apps also group expenses into separate categories, giving users a detailed insight into where their money is being spent. This allows users to identify areas where they may be overspending and make adjustments to their budget.

Have a Project Idea in Mind?

Get in touch with Savvycom’s experts for a free consultation. We’ll help you decide on next steps, explain how the development process is organized, and provide you with a free project estimate.

2.5. Insurance

Fintech app development has transformed the insurance industry by providing a platform for buying, managing, and claiming insurance policies. Digital insurance solutions aim to speed up policy administration and claims processing while reducing fraud risk.

These solutions enhance transparency and trust through self-service portals and real-time information, while also reducing costs and improving operational efficiency. Fintech app development has revolutionized the insurance industry by introducing digital insurance solutions that offer a better customer experience, greater accuracy in claims, and improved operational efficiency.

2.6. Lending & Crowdfunding Apps

Lending apps, also known as loan apps or mobile lending platforms, are mobile applications that enable individuals to borrow money directly from lenders through a digital platform.

Digital lending solutions make loan requests more efficient while also managing communications between lenders and borrowers. These apps provide both traditional financial institutions and independent digital lenders/borrowers (P2P) secure platforms to make loans and earn interest. These apps handle all aspects of loans, from loan applications to loan payment, making the process faster and more efficient.

Here are some key aspects and features of lending apps:

- Online Loan Application: Lending apps offer a streamlined online loan application process. Users can download the app, create an account, and provide the necessary personal and financial information to apply for a loan. The application typically includes details such as the desired loan amount, purpose of the loan, employment information, and identification verification.

- Quick Approval: these apps often utilize algorithms and automated processes to evaluate loan applications and make quick lending decisions. This allows borrowers to receive loan approval within minutes or hours, as opposed to traditional loan applications that may take several days or weeks.

- Digital Verification: mean leveraging technology for identity verification and creditworthiness assessment. They may use various methods such as analyzing bank account transactions, accessing credit bureau data, and employing artificial intelligence algorithms to evaluate the borrower’s ability to repay the loan.

- Flexible Loan Options: a typical lending app offer various loan options to cater to different financial needs. Users can typically choose the loan amount, repayment period, and interest rates based on their requirements. Some apps also provide personalized loan offers based on the borrower’s profile and creditworthiness.

- Disbursement and Repayment: Once a loan is approved, the funds are typically disbursed directly to the borrower’s bank account linked to the app. Lending apps usually provide flexible repayment options, including automatic deductions from the borrower’s bank account or electronic payment methods. Some apps also offer early repayment options, allowing borrowers to save on interest by paying off their loans ahead of schedule.

- Credit Scoring and Building: Lending apps may contribute to credit scoring and building for individuals who have limited or no credit history. By responsibly borrowing and repaying loans through these apps, users can establish a credit record, which may help them access traditional financial services in the future.

- Security and Privacy: Reputable lending apps prioritize the security and privacy of their users’ data. They employ encryption techniques to safeguard personal and financial information and adhere to data protection regulations to ensure user confidentiality.

2.7. RegTeg

RegTech, which is short for regulatory technology, refers to the use of advanced technology to facilitate regulatory compliance in the FinTech industry. This technology incorporates tools such as machine learning, artificial intelligence, and others to automate data governance, monitor regulatory changes, reduce false non-compliance alerts, manage compliance, and simplify reporting processes.

By using RegTech, manual and error-prone regulatory management procedures can be eliminated, making regulatory compliance more efficient and effective for FinTech companies.

3. Key Features To Consider In Fintech App Development

When planning for fintech app development to make users find valuable, it is important to include essential features that improve the user experience, provide a secure environment, and optimize operations

3.1. Secure Log In Process

Use a safe and convenient authentication method, such as single sign-on, biometrics, or multi-factor authentication. This feature secures user data and financial transactions while allowing for easy user control, such as account setup, password recovery, and profile modification.

3.2. Secure Hosting

Ensure your financial app has features like data encryption, backups, and disaster recovery by selecting a reputable and secure hosting provider that conforms with industry requirements. This ensures the integrity, availability, and confidentiality of your app’s data and services.

3.3. AI-powered Chatbots/ Voice Assistant

Using AI-powered voice assistants can reduce the workload on customer service representatives and create a more streamlined user experience. In-app chatbots can also promote additional financial services while interacting with users. Ultimately, these smart assistants can improve user engagement and differentiate your app from competitors.

3.4. Machine Learning

AI and machine learning have evolved greatly in recent years and are now contributing to the innovation of FinTech applications. You can utilize complex ML algorithms and models for your application, which will gather data from numerous sources, analyze it, and deliver individualized advise to each user based on their financial management actions and habits.

3.5. Data Security

The last important feature for fintech app development is data security. To safeguard user data and financial transactions, it’s important to establish strong data security measures such as encryption, secure APIs, and access control. It’s also important to stay vigilant and regularly monitor and update your app’s security in order to address potential threats and vulnerabilities.

3.6. Integration and APIs

Determine if your app needs to integrate with third-party financial service providers, such as banks, payment gateways, or investment platforms. Research and leverage appropriate APIs (Application Programming Interfaces) to facilitate seamless data exchange and transactions between your app and external systems.

4. Step-by-step On Fintech App Development

To get your fintech solution to the market, you will need to follow a consistent app development lifecycle with both traditional and niche-specific milestones. The development roadmap for fintech solutions is comparable to other domains, and there are several key steps that you will need to follow. Let’s take a closer look at these steps.

4.1. Choose Your Fintech Niche

When it comes to fintech app development, you need to decide on your niche and determine which area of FinTech you want to target with your app first. This will help you understand your target audience and the market potential for your app.

Once you’ve identified your niche, it’s important to create unique and innovative features that set your app apart from the competition. You can also consider upgrading an existing FinTech app by improving the UI/UX or adding more functionality to enhance the user experience.

4.2. Ensure Legal Compliance

Because FinTech is a highly regulated industry, compliance and regulation rules must be considered from the start of application development. you track compliance, be sure you build and integrate KYC, AML, and other financial protection tools. You should also be aware of privacy legislation such as the CCPA, GDPR, PIA, and LGPD in order to secure consumer financial data from illegal access. It’s also critical to understand the privacy regulations in the region of your target audience.

4.3. Define Key Features

The elements of your FinTech application will be determined by the niche you choose. Based on that, you can create the features your target market needs in order to use your application. Nonetheless, most FinTech applications require a few basic features and functions. Consider them as a starting point for your FinTech app development. You may scale the features and services that appeal to your target audience and improve their experience on your application as your application grows.

4.4. Define Monetization Strategy

Here are some common monetization strategy for fintech apps:

- Subscription: Fintech apps can use subscriptions for steady revenue from users who pay for premium features, especially personal finance management tools and investment platforms.

- Freemium: Offer a free version with basic features, and require in-app purchases or a paid plan for premium features.

- Transaction-based: The app charges fees for transactions like money transfers, stock trades, and loans. Fees can be fixed or percentage-based, depending on the transaction.

- Ads: Ads in apps can make money, but too many or intrusive ads can harm user satisfaction. So, place ads strategically and use them in moderation to maintain a positive user experience and generate revenue.

- Affiliate advertising and partnership: Partner with financial institutions or service providers to earn commissions without charging users while providing valuable services and offers.

- Big data: Fintech apps provide paid financial data for third-party companies to improve their marketing and sales strategies using AI and machine learning algorithms.

- API access with a premium: Fintech companies offer APIs for integrating payment gateways and related services into other software products. API access requires a monthly subscription fee based on usage.

4.5. Find a suitable Development Team

To develop a finance mobile app, it’s crucial to find the right people or vendors to set up your technical team. Outsourcing software development is a convenient way to save time and money, and you can easily scale up or down as needed. Setting up a development team can provide technical solutions to your development queries.

You can determine the team size, milestones, and deliverables based on your project requirements. Whether you choose cross-platform tools like Flutter or React Native or native mobile application development, you can interview and hire resources as needed.

Looking For a Trusted Tech Partner?

We’ll help you decide on next steps, explain how the development process is organized, and provide you with a free project estimate.

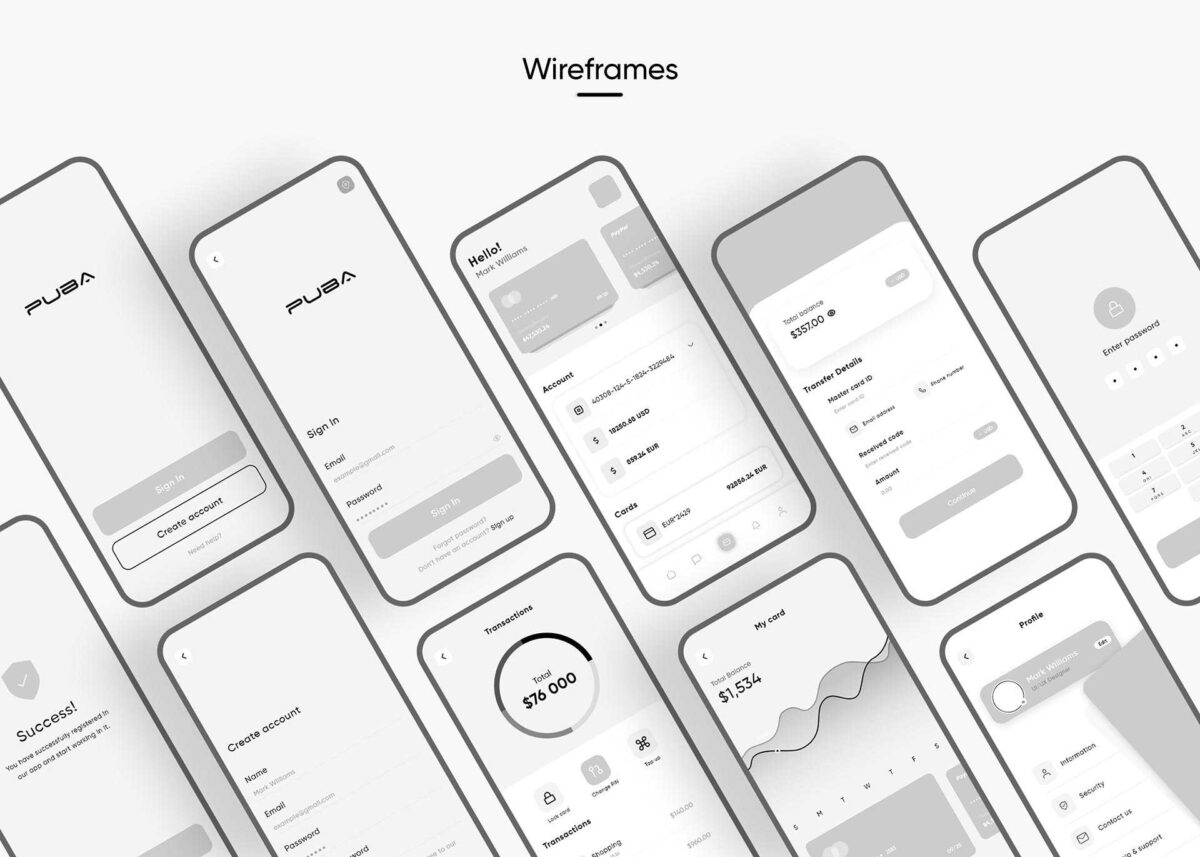

4.6. The Fintech App UI/UXI Design

Now it’s time to create the app’s interface. This is an important part of the development process because it interacts with users and attracts new ones. Hence, The UI/UX and general design of a mobile application, especially the color palette, are critical in attracting and maintaining users. You must take careful care of the design of your application and guarantee that it provides a seamless usage experience with the help of a professional designer.

4.7. Choosing Your Tech Stack

The appropriate technology, framework, and tool combination will depend on the needs of your project and the skill level of your team. Your technology stack should be capable of delivering performance, scalability, and maintainability.

Popular technologies utilized in the development of fintech apps include:

| Backend | Node.js, Python (Django or Flask), Ruby on Rails, Java, and.NET. |

| Frontend | React, Angular, Vue.js, and others Swift or Objective-C for iOS, Kotlin or Java for Android. |

| Database | PostgreSQL, MySQL, MongoDB, and Firebase |

| Cloud and infrastructure | AWS, Google Cloud Platform, Microsoft Azure |

| Security | SSL/TLS, OAuth, JWT, and encryption libraries |

4.8. MVP Development

If you are planning FinTech app development, it may be wise to start with a Minimum Viable Product (MVP). This can help you determine whether your idea has market potential while keeping development costs to a minimum. An MVP typically includes only the basic features of your app, and can be developed quickly and inexpensively.

If the MVP performs well in the market, you can consider adding more advanced features to it to enhance the user experience and offer additional value to your customers. Taking this step-by-step approach can help you build a successful FinTech app that meets the needs of your target audience while staying within your budget.

4.9. Test And Launch

Before launching your financial software to the market, you must properly test it and launch an initial version. This step is critical in ensuring that your program is ready for public usage and provides a consistent user experience.

After your app launches, employ analytics and monitoring tools to analyze its usage, performance, and other crucial metrics. This information will assist you in making educated decisions about future upgrades, enhancements, and marketing activities.

4.10. Upgrade And Improve

When developing a fintech app, it’s important to keep in mind that it’s not just a one-time project. Instead, it’s a continuous journey that requires ongoing effort and attention. This means that you should continuously improve and upgrade the app based on user feedback and new technologies to ensure that it remains competitive, user-friendly, and meets the changing needs of the market.

Moreover, providing quick and effective support to users is crucial for customer retention and attracting new ones. By doing so, you can establish a loyal customer base and increase your chances of success.

What are the core features of a fintech app?

The core features of a fintech app can vary depending on the specific focus and target audience of the app. However, here are some common core features found in many fintech applications:

- User Registration and Profile: The app should allow users to create an account and set up their profile, providing basic information like name, contact details, and sometimes identity verification.

- Account Aggregation: Fintech apps often integrate with various financial institutions to allow users to link and aggregate their bank accounts, credit cards, and other financial accounts in one place. This feature provides a comprehensive overview of their finances.

- Balance and Transaction Tracking: Users should be able to view account balances, transaction history, and detailed information about individual transactions. This feature helps users monitor their spending, income, and financial activity.

- Payments and Transfers: Fintech apps commonly offer payment functionalities, allowing users to make peer-to-peer (P2P) transfers, pay bills, and send/receive money digitally. Integration with payment gateways or digital wallets enables seamless transactions.

- Budgeting and Expense Tracking: Many fintech apps provide tools to help users create budgets, categorize expenses, and track spending patterns. They may offer visualizations, alerts, and recommendations to assist with financial management.

- Savings and Investment Tools: Some fintech apps include features to encourage savings and investment. This can include automatic savings transfers, goal setting, investment portfolio tracking, and personalized investment recommendations.

- Financial Insights and Analytics: Fintech apps often offer data-driven insights and analytics to help users understand their financial health, identify trends, and make informed financial decisions. This can include spending breakdowns, income analysis, and personalized recommendations.

- Notifications and Alerts: Push notifications and real-time alerts keep users informed about important account activities, such as low balances, transaction updates, bill reminders, or security-related notifications.

- Security and Authentication: Fintech apps prioritize security measures to protect user data and prevent unauthorized access. This can involve two-factor authentication, biometric authentication (fingerprint or face recognition), encryption, and fraud detection mechanisms.

- Customer Support and Help Center: Providing access to customer support through the app, including live chat, FAQs, and support ticket systems, is crucial for addressing user queries and concerns promptly.

- Integration with Third-Party Services: Depending on the app's focus, integration with third-party services such as payment gateways, investment platforms, credit bureaus, or insurance providers may be necessary to extend functionality.

Savvycom – Your Trusted Tech Partner

From Tech Consulting, End-to-End Product Development to IT Outsourcing Services! Since 2009, Savvycom has been harnessing the power of Digital Technologies that support business’ growth across the variety of industries. We can help you to build high-quality software solutions and products as well as deliver a wide range of related professional services.

Savvycom is right where you need. Contact us now for further consultation:

- Phone: +84 24 3202 9222

- Hotline: +84 352 287 866 (VN)

- Email: contact@savvycomsoftware.com