Financial Super App – Revolutionising Fintech in One Click

Finance super apps aren’t necessarily new, at least in terms of IT trends, having been available for at least a half-decade. Nonetheless, the disruptive wave it generates is growing. Financial super applications are quickly becoming the norm in Asian nations such as China, Vietnam, Indonesia, Singapore, etc.

So, what drives the rise of financial super apps, their effects on both consumers and businesses and the risks associated with this app type? Let’s look for the answers in this article.

Financial super app – what is it?

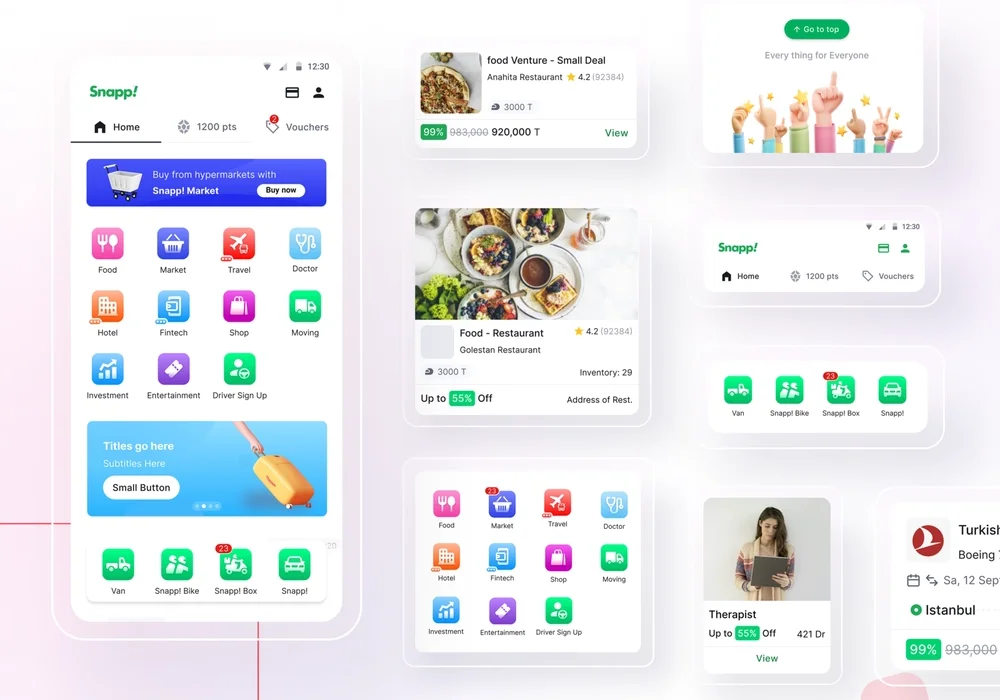

A super app is an umbrella app that offers a comprehensive system adapted to users’ daily needs through a single integrated interface or platform. The core element of this concept is user experience and continuity – allowing the user to quickly and efficiently access all available capabilities.

The following payment and financial services capabilities are often featured in the super-app: cashless payments, mobile payments, investment platforms, insurance, credit and loans, QR code payments, and so on.

Next, we will look into the detail of key financial super app features.

Features of Financial Super App

A finance super app should ideally offer a range of functions to provide extensive financial services while also catering to the different needs of consumers. Let’s go over the essential features:

- Digital payments

The app should include secure and convenient digital payment methods such as mobile wallets, peer-to-peer transfers, QR code payments, and interaction with popular platforms.

Allow users to use the app to access their bank accounts, monitor balances, make transactions (such as fund transfers and bill payments), and manage their finances.

- Investment management

Your customers might be interested in investing in stocks, bonds, mutual funds, or digital assets. Include options for portfolio tracking, real-time market data, investment analysis, and personalized suggestions in your super app.

- Personal financial management

Implement budgeting tools, cost monitoring, goal setting, or even bill payments and financial milestone alerts to assist users in properly managing their money.

- Financial insights

AI/ML technology can be utilized to provide tailored insights and suggestions based on user data, identifying areas for improvement and offering financial solutions.

- Security and privacy

Reliable security methods, such as two-factor authentication, encryption, and biometric authentication, ensure the safety of client data and transactions.

- Credit and lending

Credit and lending services remain relevant, given the world’s unpredictable financial state. Hence, you should loan calculators, eligibility checks, credit cards, and peer-to-peer lending alternatives to the super app.

- Integration with Third-Party Services

To provide a seamless user experience, the super app may connect with shopping websites, ride-hailing services, utility bill providers, and loyalty programs. Integration with Stripe and PayPal is also essential.

- Customer support

Chatbots powered by AI respond instantly and automatically to common queries, allowing users to obtain rapid solutions to their questions. In-app messaging, a ticketing system, or a specialized support crew are also options.

Get in touch with Savvycom’s experts for a free consultation. We’ll help you decide on next steps, explain how the development process is organized, and provide you with a free project estimate.

5 Examples of successful super apps

WechatPay

Tencent, one of China’s top technology businesses, created WeChat Pay, a popular financial super app. Users can use their mobile phones to make payments, transfer money, and invest in wealth management solutions. It also provides cell phone top-ups, utility bill payments, and public transportation fare payments. WeChat Pay has grown in popularity in China, with over a billion users and a brand value of about $68 billion by 2021.

AliPay

Alipay is a financial super app developed by Ant Group, a subsidiary of Alibaba Group. This app provides users with various services, such as making payments, transferring money, and accessing insurance and investment products. With a user base of over 900 million people in 2021, Alipay is now one of the most popular financial apps in China. At one point in 2020, its parent company was on course for the biggest IPO (initial public offering) ever.

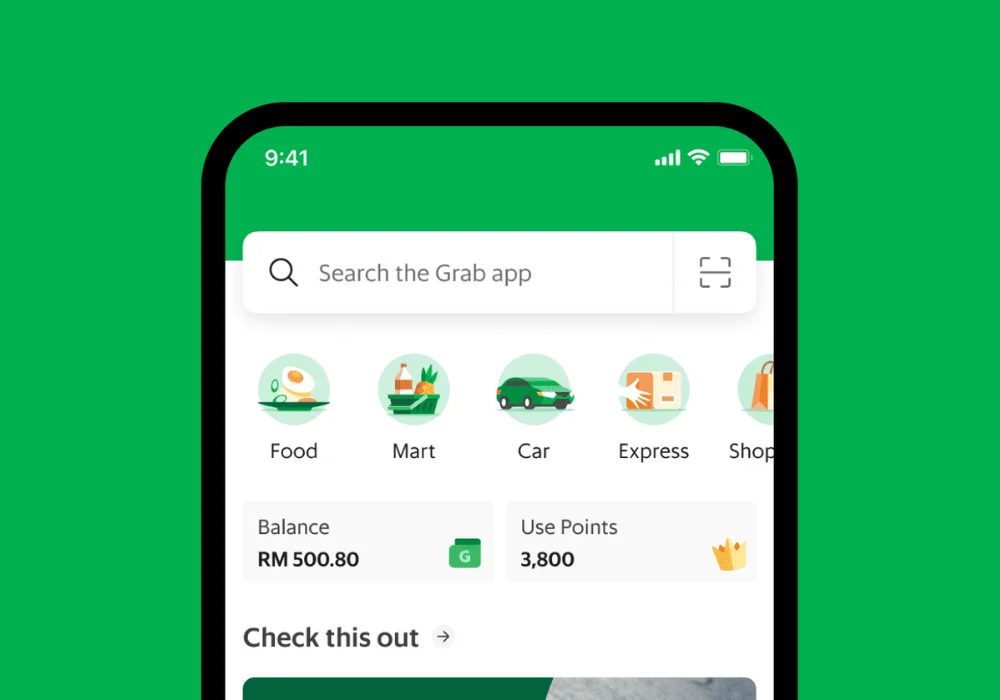

Grab

Grab has grown to become the region’s top financial super app. Grab, headquartered in Singapore and provides services comparable to Gojek, such as ride-hailing, food delivery, and on-demand services, is the regional first-mover with super app goals of offering omnichannel products and services under one virtual roof. Users can also use the app to make payments, move money, and access financial services such as insurance and investment goods. Grab has expanded its operations to various Southeast Asian nations and has over 100 million users as of 2021.

Paytm

Paytm is an Indian financial super app that provides multiple financial services, such as mobile payments, utility bill payments, and financial services, like digital gold, building bank accounts, and money transfers. With over 400 million users, the app has become one of the most popular financial mega applications in India, and its paperwork filing as of 2021 was set for the largest ever IPO in India’s history.

Gojek

Gojek is an Indonesian financial super app that provides services such as ride-hailing, food delivery, and on-demand services. Users can also use the app to make payments, move money, and take advantage of a shared ecosystem of financial services across sectors. With over 150 million users as of 2021, Gojek has become one of Indonesia’s most popular financial mega applications, the largest economy in Southeast Asia. Gojek is now worth $10 billion, with over 20 services under its super app belt.

Open banking – the technology behind super app evolution

The global spread of Open Banking enables super-apps to target users’ requirements and supply financial goods by utilizing financial data from diverse sources. This will give platforms more options to offer financial services and deliver the right services to each user.

Here are some advantages of Open Banking for super apps:

- Improved personalization: By providing a proactive ecosystem, open banking enables platforms to leverage consumers’ data and create truly personalized experiences for them.

- All financial functions are linked into a single platform: by accessing Open Banking data, the platforms may provide consumers with the ability to make payments, check account balances, and do other standard banking services through the app’s digital wallets.

-

Connecting with the right partners: As Open Banking extends into open finance and open data, super apps can access and interact with other partners.

Benefits that super apps offer consumers

The super app has added a lot of value for users. The end-user now has access to amenities that were unthinkable just a few decades ago. The banking procedure was antiquated and rigid, with the consumer on the receiving end and the bank in command of the operation.

With the introduction of super apps, customers now have more control over their finances. This has shifted the balance of power in their favor, giving them several advantages. Here are some of the most significant ones:

- Convenience

For consumers, convenience comes first. The super app has been developed to offer users a one-stop shop for their finances. To monitor account balances, make money transfers, pay bills, etc., consumers used to jump from website to website and from platform to app.

They may now go onto an app, save time and money, and have complete control and transparency over their whole financial life.

- Smarter decisions

In the past, consumers had limited financial knowledge and often needed expert help to make decisions. However, the super app has revolutionized financial decision-making by providing a clear and straightforward approach. It simplifies the process by presenting consumers with the best available options.

Impacts of super apps on banks and businesses

It’s a misunderstanding that open banking is a rival of traditional banking. Most people are unaware of the fact that open banking is an ally to traditional banking and that both banks and businesses stand to gain significantly from it.

- Banks turn to nurture valuable relationships with users

Banking institutions can focus on developing more meaningful connections with their users by letting super apps handle the administrative aspects of their traditional roles.

In the past, financial institutions had a reputation for being impersonal and insensitive. Bankers did not have the time or energy to develop a more personal relationship with their clients because of the stress of their jobs.

Financial super apps relieve financial institutions from transaction processing, data collection, risk profile creation, and all other standard banking tasks. It automates these processes so banks can increase customer loyalty and retention.

- Businesses can market their services and products more effectively

Our attention spans are getting shorter, and businesses today have to compete for a few seconds of it. We are constantly inundated with content and information, making focusing on one thing at a time harder.

Without super apps, individuals would spread their time and attention among many other apps to accomplish their goals. Their focus is centralized by the super app, enabling businesses to adapt their marketing campaigns for fresh goods and services.

Companies now know where their target market is; all they need to do is present the appropriate material to them.

Financial Super App Challenges

From the first brainstorming phase to the product’s debut, all applications encounter design and technological obstacles. Fintech super apps are no exception. We advise you to keep a watch on the following:

Design challenge

Creating a simple and easy-to-use interface requires thoughtful planning and consideration.

- Break complex procedures down into smaller steps.

- Use visual cues, progress indications, and tooltips to assist users in completing tasks quickly.

- Create recognizable navigation patterns, such as a bottom bar or hamburger menu.

- Avoid overloading users with information.

- Use visual hierarchy techniques like typeface, color, and spacing to direct attention to the most important information and actions.

- Check that the app is responsive and adaptive to multiple screen sizes and devices.

Technical challenge

Super applications often require integration with different external systems and services, such as banks, insurance, or payment providers, among others. It can be technically demanding, especially when working with many APIs, protocols, and data formats.

It is important for the developers of various components, integrated tools, programming languages, APIs, and other linked apps to ensure that all parties involved are reliable and to take necessary measures and safeguards to stay up-to-date.

Compliance challenge

Fintech’s popularity is growing, and this industry is fast developing. As it expands, regulation and compliance will be required to safeguard consumers and investors.

Assume the super app is a stand-alone app with many functionalities. In that instance, it can be challenging to keep track of all the restrictions for each service and in each region where it will be used. If multiple apps are integrated into one, each party must comply with what they are giving.

The main regulatory bodies in the United Kingdom are:

-

Prudential Regulation Authority (PRA): Regulates and supervises banks, insurers, credit unions, investment firms, and other financial services.

-

Financial Conduct Authority (FCA): Regulates financial firms offering consumer financial services, operating by charging fees to members in the financial service industry.

-

Payment Systems Regulator (PSR): Promotes competition and innovation in payment systems, working for the best interests of consumers that use them.

-

The Investing and Saving Alliance (TISA): Firms working together to improve the UK consumers’ financial well-being

-

Joint Money Laundering Steering Group (JMLSG): A private group that releases guidance on how to comply in the financial sector.

The main regulatory bodies in the European Union are:

-

European Securities and Markets Authority (ESMA): A financial market watchdog focused on regulation, facilitating cooperation between EU nations, securities legislation, overseeing markets, and investor protection.

-

Anti-Money Laundering Authority (AMLA): Prevents and impedes money laundering, sets standards, and supervises financial institutions.

-

European Central Bank (ECB): Establishes the policies for the EU, sets objectives and interest rates, and administers foreign exchange reserves.

-

European Banking Authority (EBA): Identifies weaknesses and ensures transparency in financial systems.

The main regulations to follow in the US are:

- Consumer Financial Protection Bureau (CFPB): Regulates and upholds federal consumer finance laws to guarantee that all consumers have access to markets for consumer financial products and services that are fair, transparent, and competitive.

- Securities and Exchange Commission (SEC): A governmental agency that enforces the law against market manipulation.

Data security & Protection

The risk of super applications is storing all of a customer’s critical information in one consolidated space. It is critical to protect any consumer data that is acquired. A data breach opens the door to legal action and, in the long term, can ruin the reputation of a business.

When developing a fintech super app, developers should test, debug, and attempt to “penetrate” their system to guarantee hackers cannot gain access. Additional layers and features to secure their users include:

- Two-Factor Authentication (2FA)

- Encryption

- User privacy settings and preferences to control their data

- Biometric Identification

- Regular password changes after a specific period

Monetization

Finding the right balance between providing great services to people and making cash demands considerable thought.

The following are some possible monetization options:

- Transaction fees

- Commissions

- Subscription models

- Partnerships

- Advertising

- Cross-selling financial products

Since 2009, Savvycom has been harnessing the power of Digital Technologies that support business’ growth across the variety of industries. We can help you to build high-quality software solutions and products as well as deliver a wide range of related professional services.

Savvycom is right where you need. Contact us now for further consultation:

- Phone: +84 24 3202 9222

- Hotline: +84 352 287 866 (VN)

- Email: [email protected]

![What Is Machine Learning Development And How To Develop? A Step-by-Step Guide [2024]](https://savvycomsoftware.com/wp-content/uploads/2024/04/what-is-machine-learning-development-and-how-to-develop-1-150x150.png)