Financial Risk Management Definition

“Financial risk management is the practice of protecting economic value in a firm by using financial instruments to manage exposure to risk. Similar to general risk management, financial risk management requires identifying its sources, measuring them, and plans to address them. Financial risk management can be qualitative and quantitative. As a specialization of risk management, financial risk management focuses on when and how to hedge using financial instruments to manage costly exposures to risk.” – Wikipedia

To make it simple, financial risk management is minimizing risk negative impacts on assets by appropriate financial. instruments

10 Best Financial Risk Management Software

01. Kyriba

Kyriba empowers financial leaders and their teams to manage liquidity, generate value while shielding financial risks. Internal applications for treasury, risk, payments and working capital, with vital external sources such as banks, ERPs, trading platforms, and market data providers are all connected by Kyriba’s pioneering Active Liquidity Network. Based on a highly secure, 100% SaaS enterprise platform, Kyriba delivers superior bank connectivity and a seamlessly integrated solution set for handling complex financial challenges. Kyriba has become the financial risk management software provider for thousands of companies, including many of the world’s largest organizations in New York, Shanghai, London, Singapore, Tokyo, Paris and many more. The software is supported in Arabic, English, French, German, Spanish, Italian, Chinese, Polish, Portuguese, Japanese, Russian, Romanian, Serbian.

Main features:

- Treasury Management

- Fraud Detection

- Risk Management

- Supply Chain Finance

- Payments

02. Murex

Murex’s MX.3 shortens the gap between the capital market operators and financial risk management systems. The platform enables financial services firms to participate in capital markets and efficiently manage the credit, liquidity risk and market across all asset classes despite complex and far-reaching regulatory requirements through offering cutting-edge risk solutions.

The software can deal across numerous asset instruments and classes, making it flexible and easily integrated within existing IT and risk infrastructure institutions.

“Strong end-to-end capabilities from front office, to middle office and back office. Project management team is solid; deliver team (and support) is responsive. Prices can be quite high compared to competitors.” Review by a Program and Portfolio Manager on Gartner

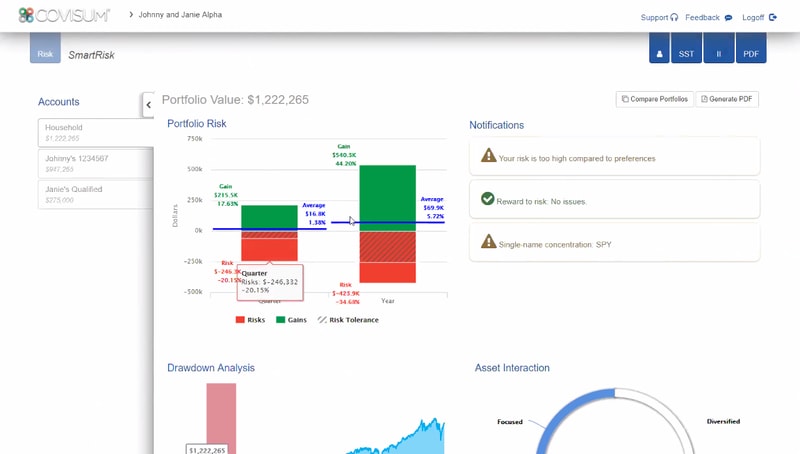

03. SmartRisk

SmartRisk is a financial risk management tool specially designed to support financial advisors in analyzing portfolio risk to motivate clients to make portfolio changes, retain clients during a down market and prevent clients from making investment mistakes. Clients are often not sensitive to market risk and don’t have precise downside expectations either too conservative or too reckless, resulting in inaccurate investment allocations. SmartRisk empowers advisors to communicate efficiently with clients to avoid investment mistakes.

Main Features:

- Portfolio Modeling

- Reporting

- Risk Analytics

- Market Risk Management

- Portfolio Management

- Portfolio Modeling

- Reporting

- Risk Analytics

- Stress Tests

04. FactSet

FactSet is the financial risk management software focusing on time-management problems. The platform is equipped with multi-asset class portfolio analytics, saving advisors time in managing data. With advanced portfolio analytics, performance, and attribution, clients get an unparalleled combination of portfolio equity and fixed income analytics, data concordance management, workflow capabilities, and data distribution for internal and external clients.

Main Features:

- Portfolio Analytics:

- Performance & Attribution

- Connected Teams

- Unique Content

- Performance Drivers

- Flexible Reports

- Risk Analytics:

- Optimized Portfolios

- Risk Models

- Risk Over Time

- Connected Teams

- Stress Testing

- Quantitative Research:

- Portfolio Simulation

- Backtesting

- Data Exploration

- Characteristics Analysis

- Portfolio Optimization

- Performance Measurement & Attribution:

- Returns Analysis

- Relative & Absolute Performance

- Integrated Data

- Reporting & Distribution

- Attribution Models

- GIPS Compliance

- Client & Portfolio Reporting:

- Consistent Branding

- Trusted Analytics

- Commentary in Seconds

- End-to-End Reporting

- User-Empowered or Managed Services

- Oversight and Approvals

05. Calypso

Calypso delivers cross-asset solutions for trading, risk, processing, control derivatives, treasury and securities systems. The users of Calypso include sell-side financial institutions such as banks and prime brokers, buy-side firms such as investment managers, asset managers, hedge funds, family offices, insurers and corporations, as well as treasury services providers including exchanges, clearers and service consortiums.

Main features:

- Compliance Management

- Credit Risk Management

- For Hedge Funds

- Liquidity Analysis

- Market Risk Management

- Operational Risk Management

- Portfolio Management

- Reporting

- Risk Analytics

06. FINCAD

FINCAD is an integrated multi-asset portfolio and financial risk management software company. The platform is transparent with comprehensive cross-asset coverage and documentation of all models, calculation methodologies, and references. The clients of the software include firms such as investment managers, asset managers, hedge funds, pension funds, banks, auditors, insurers and corporations. With various tools, FINCAD enables financial firms to manage risk while complying with sophisticated regulations.

Main features:

- Portfolio management

- Portfolio analysis

07. GTreasury

GTreasury is a platform that gives firms cloud access to an end-to-end workflow for integrated treasury management and financial risk management solutions and services. Its single database, connectivity and workflow unifies technology and makes working smarter. GTreasury offers a SaaS solution that can integrate Payments, Cash Management, Financial Instruments, Banking, Accounting, Risk Management, and Hedge Accounting.

Main features of this risk management product:

- Cash Management

- Financial Instruments

- Banking

- Accounting

- Funds Transfers

- SaaS & Installed Platforms

- Illuminating Liquidity

- Treasury

- Treasury Management

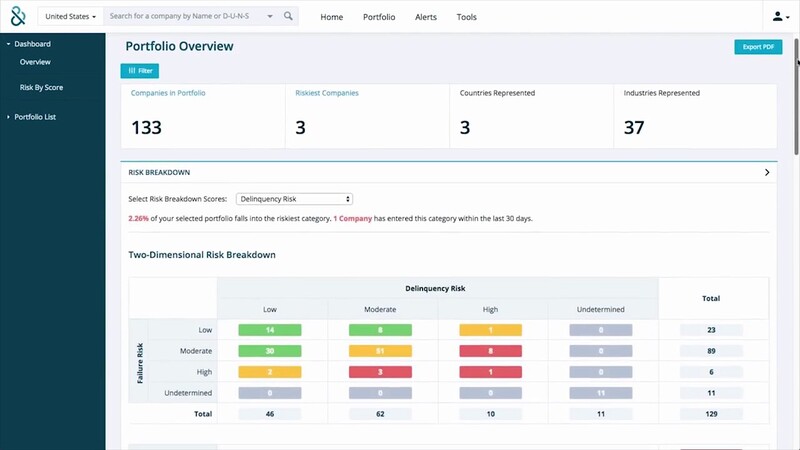

08. D&B Credit

D&B Credit is a cloud-based financial risk management software powered by Dun & Bradstreet’s industry-leading data and analytics. Finance and credit professionals can function more effectively and drive sustainable and profitable growth with the help of powerful portfolio segmentation tools, configurable alert tracking, and easy-to-read digital credit reports. The system supports multiple languages, currencies and provides customizable views, tagging options to flexibly manage customer portfolios.

“That recommended credit limit is paramount to us…I love the way that the data flows.” Paul Laska, Credit Manager, A.N. Deringer reviews on D&B Credit website.

09. MetricStream

MetricStream is a leading provider of enterprise and cloud applications for governance, risk and compliance (GRC). M7 Operational Risk Management is a popular system developed by the company, supplying numerous tools to establish efficient operational risk management. The system is easily integrated into users’ companies’ risk management processes to enhance financial performance, protect investment capitals and equity.

“We’ve successfully rolled the tool out to all 3 lines of defense and are overall pleased with the realized value. Through MetricStream we’ve also purchased additional Tableau licenses, which allows us to manipulate, analyze, and present the data in ways that we weren’t capable of pre-MetricStream and common GRC framework.” – Reviewed by a Risk Analyst on Gartner

10. Reval

Reval is a leading treasury and risk management platform, including managing cash, liquidity and financial risk through its cloud-based offerings, helping clients with their usage of financial instruments and hedging activities. Thanks to the cloud platform, clients can optimize operational efficiency, security, control and compliance, enhancing the overall performance.

Main features:

- Risk Management

- Hedge Accounting And Compliance

- Cash And Liquidity Management

- Treasury Management System

- SaaS

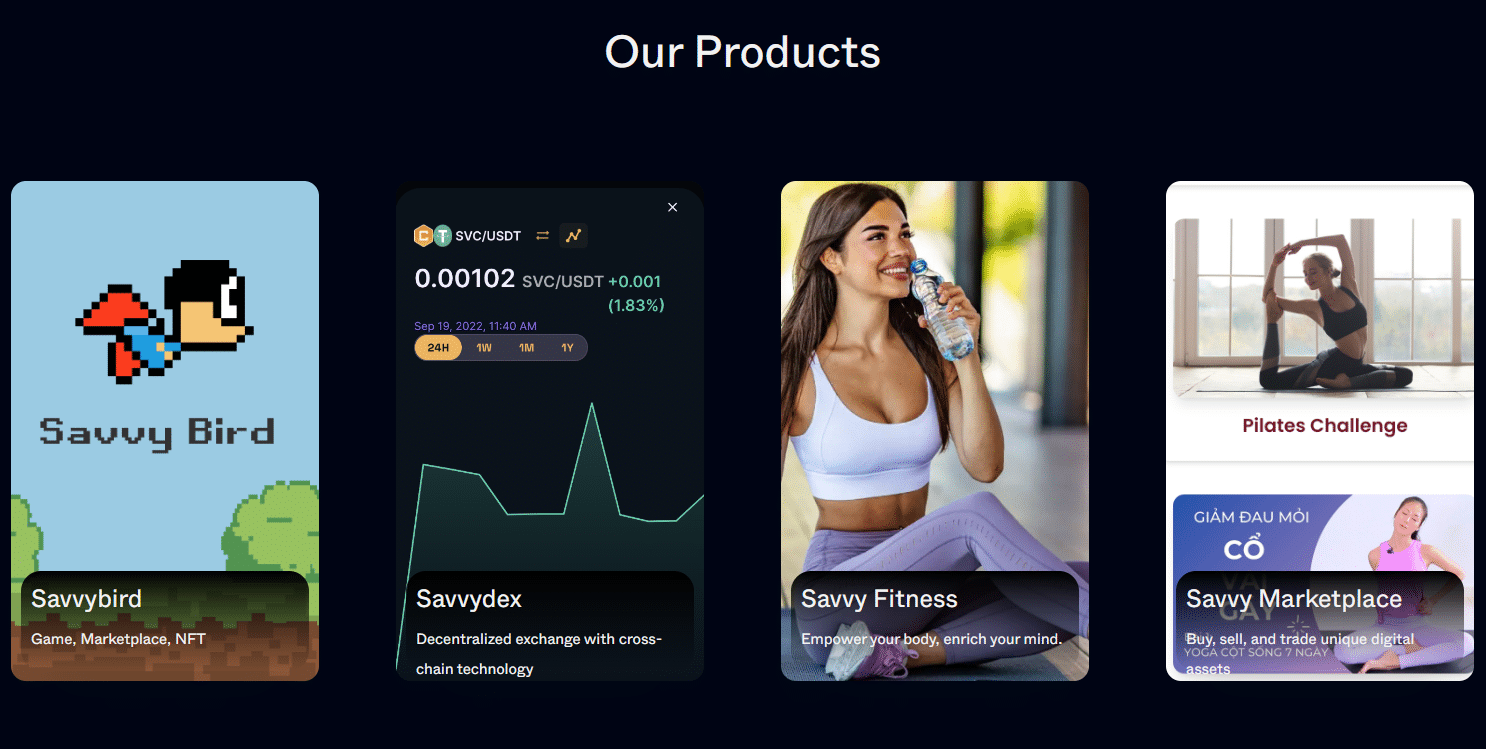

Savvycom – Your Trusted Tech Partner

Savvycom offers expertise in tech consulting, end-to-end product development, and software outsourcing, utilizing digital technologies to drive business growth across industries. With a focus on delivering high-quality software solutions and products, we provide a wide range of related professional software development services tailored to your specific requirements.

Savvycom is right where you need. Contact us now for further consultation:

- Phone: +84 24 3202 9222

- Hotline: +84 352 287 866 (VN)

- Email: contact@savvycomsoftware.com

How often should risk assessments be performed?

Risk assessments should be performed regularly and whenever significant changes occur within a business or its external environment. Typically, businesses conduct these assessments annually, but more frequent assessments may be necessary in rapidly changing markets or industries.

Additionally, it's crucial to reassess risks when introducing new products or services, entering new markets, or experiencing major organizational changes, This ensures that all potential risks are identified and managed effectively.

What is financial software?

Financial software, also referred to as financial system software, serves as a specialized toolset aimed at streamlining and managing monetary activities across businesses, organizations, and personal finances. These solutions encompass a diverse array of functionalities, ranging from accounting systems and payment gateways to budgeting apps and financial forecasting tools.

By automating tasks and facilitating transactions, financial software significantly enhances efficiency and ensures accurate financial reporting. It empowers users to track expenditures, monitor revenues, manage budgets, and adhere to regulatory requirements, fostering financial transparency and accountability. As digitalization gains momentum, the demand for robust financial software grows, spurring innovation and evolution in the fintech industry.

We take pride in being one of the foremost software development companies and IT outsourcing services in the ASEAN region. Savvycom offers comprehensive assistance for your business in planning and developing financial analysis software solutions, all without the burden of excessive costs. Share your ideas with us today, and let’s work together to bring them to fruition! Feel free to reach out to us for further consultation today!

Who needs financial software?

Financial software is essential not only for finance experts or big companies but for a wide range of users. Individuals and families can use it to manage budgets and track expenses, gaining better financial control.

Small businesses and freelancers can benefit from features such as invoicing, tax preparation, and payroll management, which simplify finance tasks. Large corporations can utilize financial reporting software for detailed financial analysis and forecasting, aiding strategic decision-making.”+

Non-profit organizations can also benefit from financial software by simplifying donation tracking and fund allocation, ensuring transparency and accountability. Financial advisors and accountants can streamline operations, enhance client service, and ensure regulatory compliance with advanced financial software. In essence, almost anyone dealing with finances – which includes most of us – can benefit from using financial software in some capacity.

Importance of financial application development?

Financial software simplifies complex problems for individuals and businesses

Financial application development involves creating software that helps individuals or organizations manage, track, and analyze their finances. There are several reasons why it’s important:

- Audience: These applications serve different types of users like individuals, small businesses, large corporations, banks, or governments. Each group has unique needs, and financial apps offer tailored solutions.

- Process: Development includes planning, designing, coding, testing, deploying, and maintaining. Attention to detail, quality, and security is vital due to the sensitive data involved. Compliance with laws and regulations, like data protection and accounting standards, is necessary.

- Benefits: Financial apps improve efficiency, accuracy, security, and decision-making for users. They enhance user experience, satisfaction, and loyalty while boosting revenue and profitability.

In essence, financial application development is a crucial task demanding expertise, creativity, and innovation.

Types of financial software

There’s a variety of financial software available, offering businesses and individuals numerous choices. However, not all software enjoys widespread popularity. Let’s summarize and analyze some of the popular styles that garner high traffic and usage.

1. Accounting systems

Accounting systems are vital for effectively managing financial operations. They come in various forms, each tailored to specific business requirements:

- General Accounting Software: This software records and processes financial transactions such as invoices, payments, and expenses. It generates detailed reports and statements to evaluate a business’s financial status.

- Enterprise Resource Planning (ERP) Software: Financial planning software systems integrate different business functions like accounting, human resources, and inventory management. They offer a centralized platform to streamline operations and facilitate decision-making.

- Payroll Software: Designed to handle employee payroll, this software automates payroll processing, tracks work hours, and ensures compliance with tax regulations. ADP stands out as a notable example in this field.

- Billing and Invoicing Software: It will simplify the management of payable and receivable accounts by automating tasks and minimizing errors associated with manual data entry.

- Inventory Management Software: These systems help businesses monitor inventory levels, orders, and deliveries, optimizing stock control and cutting costs.

These software solutions cater to businesses of all sizes, enhancing efficiency, accuracy, and transparency in financial management.

2. Payments gateway

Payment gateways are crucial middlemen in online transactions, making it easy to process payments using credit and debit cards. They securely connect merchant and customer bank accounts, verifying banking and card details, ensuring enough funds, and transferring data between banks for safe transactions.

It’s impressive how payment gateways smoothly integrate with various software platforms for online payments, showing their flexibility. The global payment gateway market, valued at $32.52 billion in 2023, has grown steadily at a rate of 22.2%, highlighting their vital role in digital payment commerce.

Savvycom, a trusted provider in designing and providing finance solutions

In addition, financial software development companies like Savvycom that offer financial software development services, lead the way in payment processing, using technology and adaptability to navigate the changing landscape of online business. The shift to online commerce due to the pandemic has pushed payment gateways even further into the spotlight of FinTech innovation, confirming their importance in modern financial systems.

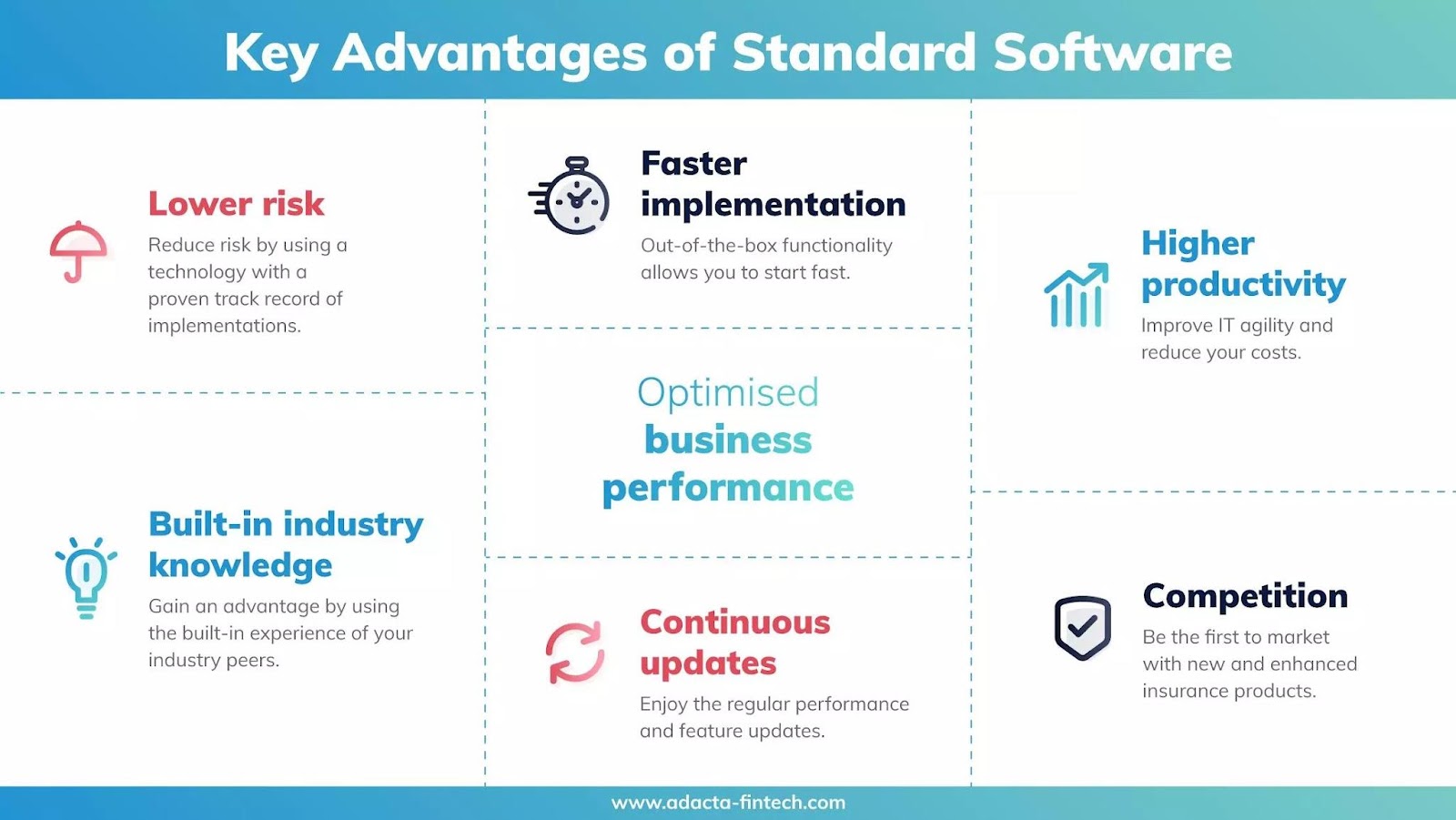

3. Insurance

Insurance technology (InsureTech) is among the fastest-growing segments in financial applications, with an impressive Compound Annual Growth Rate (CAGR) of 34.4% and a projected value of $1.19 billion by 2027. The evolution of InsureTech has brought about a new wave of innovation, where data from wearables and similar devices play a crucial role in providing highly personalized services. This new generation of InsureTech platforms utilizes wearable data to offer dynamic insurance plans and personalized recommendations to customers.

The insurance software market remains a valuable opportunity for businesses

Source: Adaca fintech

Interestingly, smaller insurance companies are embracing this trend, venturing into areas that larger peers traditionally avoided. In doing so, these smaller firms not only explore new opportunities but also reduce customer acquisition costs, thereby enhancing their competitiveness in the market.

4. P2P lending platforms

Peer-to-peer (P2P) lending platforms mark a significant shift in borrowing and lending, allowing individuals to borrow directly from others in a virtual marketplace. These platforms, driven by decentralization, connect borrowers with investors without traditional financial intermediaries. P2P lending platforms prioritize reducing operational costs, offering more attractive terms to investors than traditional banks.

According to Webisoft, the global P2P lending market is expected to reach $558.91 billion by 2027, with a growth rate of 29.7%, driven in part by pandemic-related challenges. As more companies adopt P2P lending, these platforms transform lending practices, making capital more accessible and promoting decentralized borrowing and lending.

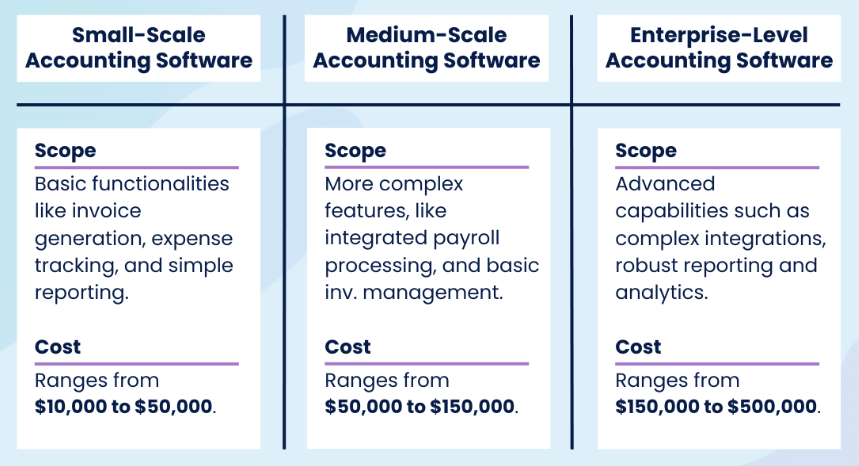

Development cost?

Understanding the cost dynamics of financial software development involves considering various critical factors and estimation methodologies. The development cost is influenced by factors such as scope, complexity, technology stack, and human resources. These elements collectively determine the overall expenses of building software solutions.

Latest price list on costs of building financial software

Estimating development costs entails analyzing project scope, complexity, and technology resources needed. Techniques like bottom-up estimation and analogous estimation help derive accurate cost projections. These methods take into account project size, duration, and required functionalities to establish a realistic budget framework.

For small-scale accounting software projects, costs typically range from $10,000 to $50,000, depending on project size and duration. Medium-scale projects may incur expenses ranging from $50,000 to $150.000, considering complexity and required features. Large-scale or enterprise-level accounting software development may involve significantly higher costs due to extensive integrations, scalability, and maintenance requirements.

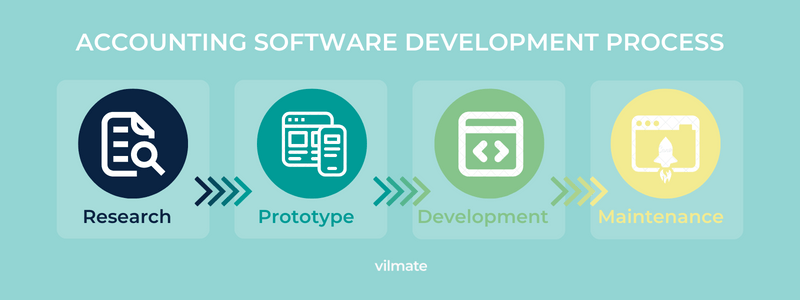

How to build financial software?

Quick steps to build financial software

Building financial software requires careful planning and execution to make sure it works well and is dependable. Here’s a clear plan to help you through the development process:

- Define Project Requirements: Start by understanding what your financial software needs to do. Think about things like managing accounts, processing transactions, generating reports, and keeping things secure.

- Market Research: Look closely at what users want, what your competitors are offering, and where the industry is heading. Find out what’s missing in current solutions so you can make your software fit the market better.

- Select Technology Stack: Choose the right tools and frameworks based on what your project needs and how big you expect it to get. Think about security, speed, and making sure it can grow with updates.

- Design Architecture: Create a strong plan for how everything in your software will fit together. Decide how data will be organized, what different parts of the system will do, and how new features can be added later on.

- Develop Core Features: Start building the most important parts first, like letting users log in, managing accounts, and handling transactions. Put the most useful things first, based on what users need and what’s standard in the industry.

- Implement Security Measures: Make sure your software keeps financial data safe from hackers and other threats. Use encryption, special logins, and check regularly to make sure everything stays secure.

- Test and Quality Assurance: Check your software thoroughly to find and fix any problems. Test how it works, how different parts fit together, and how secure it is to make sure users have a smooth experience.

- Deployment and Maintenance: Once your software is ready, launch it in a controlled way and keep an eye on how it performs. Keep updating and fixing it to make sure it keeps working well and meets users’ changing needs.

By following these steps, you can create financial software that’s reliable and meets the needs of users and the industry.

Conclusion

In summary, creating financial software is a strategic investment for organizations, enabling precise financial management and decision-making. The process, from planning to implementation, demands a focused approach to ensure that the software aligns with specific business needs and offers a secure, scalable, and efficient financial management solution. Ultimately, we hope the question “how to build financial software?” was clear for you.

Unlocking Digital Potential: Financial software, App Development, Cloud & DevOps Services and more! Since 2009, Savvycom has been at the forefront of leveraging digital technologies to empower businesses, mid and large enterprises, and startups across diverse industries. As a software development firm, let us guide you in crafting top-notch software solutions and products while offering an array of professional services tailored to your needs…

Savvycom is right where you need. Contact us now for further consultation:

- Phone: +84 24 3202 9222

- Hotline: +1 408 663 8600 (US); +612 8006 1349 (AUS); +84 32 675 2886 (VN)

- Email: contact@savvycomsoftware.com

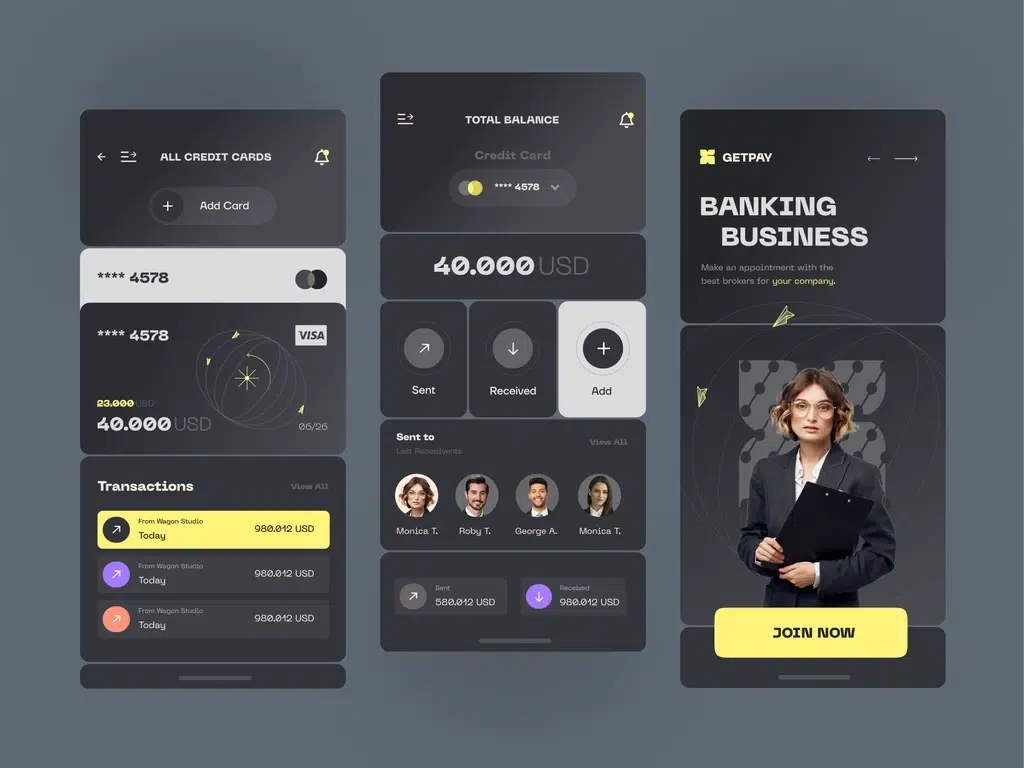

Blockchain App Market Overview

Blockchain technology, a cornerstone of the Internet of Things (IoT), is revolutionizing industries worldwide with its decentralized ledger capabilities. From finance to healthcare, its applications offer transparency and heightened security, transforming how businesses operate. The blockchain app market is experiencing substantial growth, projected to reach $12.3 billion by 2030. This surge is propelled by the increasing adoption of cryptocurrencies and the integration of blockchain across diverse sectors such as retail and finance.

Emerging trends like DeFi (Decentralized Finance), NFTs (Non-Fungible Tokens), and enterprise adoption are reshaping the market landscape, paving the way for innovative solutions. Despite the evolving regulatory frameworks, which pose both challenges and opportunities for development and adoption, the blockchain market continues to expand. Successful ventures like Ethereum exemplify the immense potential of blockchain, contributing significantly to market growth.

With a remarkable Compound Annual Growth Rate (CAGR) of 57%, the future of blockchain technology is poised for robust expansion, promising sustained influence throughout the IoT ecosystem.

Looking For a Dedicated Team?

Looking to strengthen your manufacturing operations with state-of-the-art Blockchain technology? Look no further than Savvycom! With over 15 years of expertise in IT development, Savvycom specializes in providing customized Blockchain solutions to cater to the unique needs of your industry. Partner with us for expert Blockchain consulting, as Asia’s premier IT outsourcing company, and harness the power of innovative technology to streamline and secure your manufacturing processes. Let’s collaborate to enhance your operational efficiency and propel your business to new heights of success!

Criteria For Top 10 Blockchain App Developers

There are several factors that we have taken into consideration to compile this list. Some of these factors include:

- Experience: Prioritize firms with extensive experience, considering their tenure, successful projects, and client roster.

- Technical Expertise: Look for proficiency in various blockchain technologies like Hyperledger, Ethereum, and Solidity.

- Client Satisfaction: Value a strong reputation for client satisfaction, evidenced through positive feedback and testimonials.

- Product Quality: Emphasize commitment to delivering high-quality products, ensuring project success.

- Industry Recognition: Consider recognition, awards, and partnerships with leading companies as indicators of excellence and credibility.

- Team Size: Assess both larger teams for resource depth and smaller teams for personalized attention, based on project requirements.

- Flexibility: Prioritize firms that can adapt to changing project needs and timelines for successful project delivery.

- Cost-effectiveness: Evaluate competitive pricing while maintaining quality and adherence to timelines in the selection process.

The Top 10 Blockchain App Development Companies In Asia

With the amount of attention blockchain technology has been attracting, here is the list of the leading Blockchain app Development services you can work with.

1. Savvycom

As the first and only member of the Apple Consultants Network in Vietnam, Savvycom has also partnered with other global leaders

The first on the top 10 list today is Savvycom, a leading custom blockchain app development firm in Vietnam that has established itself as an industry pioneer through a commitment to innovation and client satisfaction. With over 15 years of experience, Savvycom excels in providing tailored blockchain solutions for businesses of all sizes, leveraging expertise in platforms such as Hyperledger, EVM, Solidity, Cosmos, and Substrate. Their comprehensive services span consulting, design, and development, aimed at expediting time-to-market and optimizing ROI.

Highlighted projects, such as the collaboration with Morpheus Labs, underscore Savvycom’s prowess in executing successful blockchain initiatives, bolstering its credibility. Savvycom boasts a team of blockchain developers proficient in Ethereum, Tezos, and Hyperledger, having completed numerous 500 projects. Client testimonials further attest to Savvycom’s commitment to excellence.

Learn more about Savvycom

2. Creatix Technologies

Creatix Technologies focused on helping businesses grow through digital transformation services

Creatix Technologies, headquartered in Armenia, is a leading company in blockchain consulting service, catering to various industries including finance, healthcare, and real estate. With a focus on creating custom blockchain solutions, Creatix adapts each project to meet the unique requirements of its clients, seamlessly integrating these solutions into existing business frameworks. The experienced team at Creatix is dedicated to delivering top-notch results, consistently surpassing client expectations.

By harnessing advanced technologies such as Ethereum, EOS, Solana, and NEAR, Creatix leads the way in innovative blockchain development, making complex concepts easy for businesses to navigate. Offering a full range of services from consultation to smart contract development and enterprise blockchain solutions, Creatix has a proven track record of successfully delivering projects that improve transparency, streamline processes, and generate tangible business value. With its impressive portfolio, Creatix Technologies is the preferred partner for startups and enterprises seeking cutting-edge blockchain solutions.

Learn more about Creatix Technologies

3. Appikr Labs

Appikr Labs Provides Mobile App Development Solutions For Brands And Companies With Objective To Generate Revenue In Billions Through “Fortune 500 Apps”

Appikr Labs, headquartered in Dubai, has been a leading figure in blockchain development services since its inception in 2015. They specialize in various areas including blockchain consulting, smart contract development, and decentralized application creation, serving industries such as finance, healthcare, and supply chain management. What sets Appikr Labs apart is its skilled team of experienced blockchain developers proficient in technologies like Ethereum, Hyperledger, and Corda. They have a notable track record of delivering innovative solutions like a voting system and a secure property title management platform for the real estate sector.

One of the key strengths of Appikr Labs is their ability to simplify complex blockchain concepts and transform them into easy-to-use applications. This has made them a preferred choice for both startups and established enterprises. With a commitment to delivering high-quality solutions that surpass client expectations, Appikr Labs continues to lead the way in blockchain innovation. Additionally, they offer educational services to help businesses harness the transformative potential of blockchain technology.

Learn more about Appikr Labs

4. Labrys

Blockchain services that Labrys provides

Labrys is Australia’s top spot for cutting-edge Web3 solutions. Since 2017, Labrys has quickly become the largest Web3 development agency in the country. They specialize in using blockchain infrastructure and Web3 technologies to create innovative products. Labrys takes a comprehensive approach, not only developing groundbreaking solutions but also building the necessary supporting infrastructure like web and mobile applications, APIs, and integrations to support any Web3 project.

What sets Labrys apart is its team of experienced blockchain developers and consultants. They’re experts in Ethereum, Hyperledger, Corda, and more. But Labrys isn’t just about delivering solutions; it’s also about educating and empowering businesses. Through their blockchain education services, Labrys helps organizations in various industries understand how to leverage blockchain’s potential, keeping them ahead in today’s digital world.

Learn more about Labrys

5. Sotatek

Embrace innovation, empower possibilities

SotaTek is a leading name in Blockchain Development and IT Consulting, with a global presence spanning seven offices worldwide and a strong team of over 500 skilled blockchain developers and consultants. Known for their versatile expertise, SotaTek offers a wide range of services, from full-stack public blockchain development to the creation of state-of-the-art NFT marketplaces, dex platforms, blockchain-based games, and essential infrastructure such as E-wallets and POS systems.

Their commitment to innovation and excellence shines through in their dynamic approach to crafting solutions tailored to various business needs. With a proven track record in payment processing, digital identity verification, and document management, SotaTek stands out as a leader in the Vietnamese blockchain development scene. They consistently set high standards for the industry and prioritize client satisfaction above all else.

Learn more about SotaTek

6. Cubix

Unleashing the potential of blockchain, one block at a time

Cubix, based in Singapore, is a leading blockchain development company that’s making waves globally. With a team of over 250 experts, they’re delivering tailored and robust blockchain solutions to businesses in more than 50 countries. They specialize in key areas like blockchain supply chain, decentralization, and E-wallet platforms, drawing on their extensive experience to meet the unique needs of clients worldwide.

Having completed over 200 successful projects, Cubix has built a solid reputation for providing top-notch, dependable solutions in blockchain development, smart contract implementation, decentralized applications, and digital tokenization. Their commitment to excellence and innovation is evident, driving progress in the industry and helping businesses thrive in the digital.

Learn more about SotaTek

7. T-Mining

Empowering the digital future of logistics

T-Mining, a leading blockchain company based in Singapore, has been reshaping the digital world since its establishment in 2016. Focused on decentralized technologies, T-Mining has introduced its innovative Decentralized Technologies Framework (DTF). This framework aims to speed up the creation of decentralized applications (dApps) while keeping costs in check.

By utilizing reusable features, DTF makes it easy and quick to develop dApps, especially for supply chain purposes like Maritime, Port, and Logistics sectors. T-Mining is well-known for its expertise in building advanced trading systems and financial software, earning recognition in the financial industry. Collaborating with esteemed financial institutions, T-Mining excels in smart contract development, integrating blockchain technology, and tailoring blockchain solutions to specific needs.

Their proficiency extends across various blockchain platforms such as Ethereum, Bitcoin, and Hyperledger Fabric, solidifying their position as pioneers in blockchain innovation.

Learn more about T-Mining

8. Tradeline

Transforming transactions, empowering trust through blockchain innovation

Tradeline is shaking up commodity trading with its innovative platform for automating post-trade workflows. Positioned at the forefront of this sector, Tradeline leads the pack with its cutting-edge technology, which not only streamlines communication and transparency within organizations but also ensures robust management of electronic contracts.

Drawing on its expertise as a blockchain development company, Tradeline delivers top-tier solutions tailored to diverse sectors, ranging from finance to supply chain management. Their seasoned team specializes in crafting blockchain-based solutions that place utmost importance on trust, transparency, and security.

By harnessing distributed ledger technology, Tradeline empowers businesses to streamline operations, slash costs, and bolster security measures. From initial consultation to full-scale implementation, Tradeline caters to businesses of all sizes, forming partnerships with industry titans like Visa and Nasdaq.

Learn more about Tradeline

9. Appsynth

Crafting digital experiences that transform businesses

Appsynth, a leading player in the blockchain arena across Thailand and Asia, is dedicated to pushing the boundaries of Distributed Ledger technology. With a fervent commitment to continual growth and innovation, the team focuses on unlocking the full potential of blockchain advancements.

Despite being headquartered in Bangkok, Thailand, expertise extends globally, offering tailored solutions for blockchain development. Specializing in Ethereum, EOS, and Hyperledger Fabric, a spectrum of services is delivered ranging from comprehensive consulting to end-to-end product development. From strategizing and feasibility studies to seamless integration planning, solutions prioritize security, scalability, and future-readiness. Beyond blockchain, proficiency extends to web and mobile app development, ensuring every client’s unique requirements are met.

At Appsynth, the mission is clear: to deliver unparalleled service and project management, empowering businesses to thrive in the ever-evolving digital landscape.

Learn more about Appsynth

10. Finwin Technologies

Empowering Financial Transformation

Finwin Technologies is a leading force in digital platform engineering and software development, offering top-notch IT solutions designed to adapt to the changing needs of businesses worldwide. Specializing in Fintech and AI, we help enterprises achieve rapid and cost-efficient growth. Renowned for our expertise in blockchain, we provide cutting-edge decentralized solutions such as cryptocurrency development, dApp creation, and ICO consulting.

Additionally, we excel in mobile app, AR/VR, and AI/ML development, showcasing our versatility across various industries. With a strong reputation for client satisfaction and proven success in healthcare, finance, logistics, and real estate, we are recognized for our excellence in IT innovation. Our commitment to delivering high-quality solutions has established us as a premier blockchain development company in Thailand.

Learn more about Finwin Technologies

Vietnam: A Rising Hub for Blockchain Outsourcing Endeavors

Vietnam is becoming a top choice for blockchain outsourcing, thanks to its skilled workforce, cost-effectiveness, and supportive government. With nearly 70% of its population under 35 and proficient in cutting-edge technologies like blockchain, Vietnam offers a rich talent pool. Its strong technology education system churns out over 600,000 IT engineers yearly, well-versed in coding and possessing good English skills.

Moreover, the government actively promotes entrepreneurship and digital transformation, boosting Vietnam’s appeal as a global tech hub. Thus, Savvycom, a prominent enterprise blockchain app development company with over 15 years of experience and more than 500 projects completed, offers top-notch blockchain solutions for businesses of all sizes.

Collaborating with firms like Savvycom ensures innovative and successful outcomes as Vietnam solidifies its position in the blockchain industry.

Conclusion

In Asia, the blockchain app development companies thrives with talent and innovation. The listed companies are top players in the industry, each offering distinct strengths. As blockchain tech progresses, these firms are poised to pioneer solutions that are both cutting-edge and practical. Whether you’re a startup or a big business, teaming up with these developers can unleash blockchain’s potential to revolutionize your operations.

Savvycom – Your Trusted Tech Partner!

Transforming Manufacturing with Cutting-Edge Blockchain Solutions with Savvycom, Asia’s Premier software development company, has been leading digital innovation since 2009. Drawing on our extensive experience, we specialize in developing cutting-edge Blockchain solutions customized to your requirements. Whether it’s supply chain optimization, smart contracts, or decentralized applications, we offer comprehensive solutions to revolutionize manufacturing processes. Partner with us to harness the power of Blockchain technology and drive innovation in your industry.

Savvycom is right where you need. Contact us now for further consultation:

- Phone: +84 24 3202 9222

- Hotline: +84 352 287 866 (VN)

- Email: contact@savvycomsoftware.com

Frequently Asked Questions

Which company is best for blockchain development?

Looking for top-notch companies in blockchain development? Here are some renowned names:

-

ConsenSys: Leading the pack with its expertise in Ethereum-based solutions and decentralized applications (dApps).

-

IBM: Known for its IBM Blockchain platform, catering to high-level blockchain applications for businesses.

-

Deloitte: Offers consulting and development services across various industries, providing tailored blockchain solutions.

-

Microsoft: With Azure Blockchain Services, it equips developers with tools and infrastructure on the Microsoft Azure cloud platform.

-

Chainyard: Specializes in offering comprehensive blockchain services, from consultation to implementation, specifically tailored for enterprises.

-

Accenture: Delivers blockchain solutions across different sectors like supply chain, finance, and healthcare, ensuring industry-specific needs are met.

-

Coinbase: Famous for its cryptocurrency exchange platform, it also extends its expertise to blockchain development services and developer tools.

Remember, before making a choice, ensure to thoroughly research each company’s track record, experience, and previous projects to find the best fit for your specific blockchain development needs.

This hype train was originally created by Bitcoin – the most famous application of Blockchain in cryptocurrency. Now, most leaders believe that Blockchain will be the most influential force in the transformation of industries practice as we know it. In fact, at the 2016 MedCity Converge conference, Nishan Kulatilaka – Merck associate director for applied technology, noted:

Blockchain In Healthcare

“Healthcare could be the second-largest sector to adopt the Blockchain technology, after financial services.”

Undoubtedly, positioning your business as the frontrunner in adopting the next major technological breakthrough promises to secure a significant share of the market and generate profits.

However, Blockchain remains an emerging technology with no predetermined formula for success. Therefore, engaging in haphazard experiments with Blockchain solutions lacking clear objectives and a feasibility assessment process is unlikely to yield substantial returns for your company.

In this piece, Savvycom Insight aims to assist you in comprehending: What exactly is Blockchain? How will its implementation unfold in the Healthcare industry? What obstacles should you anticipate? And if you opt to confront these challenges, what strategic approaches can you employ? This insight is particularly relevant for software development companies seeking to navigate the complexities of Blockchain integration.

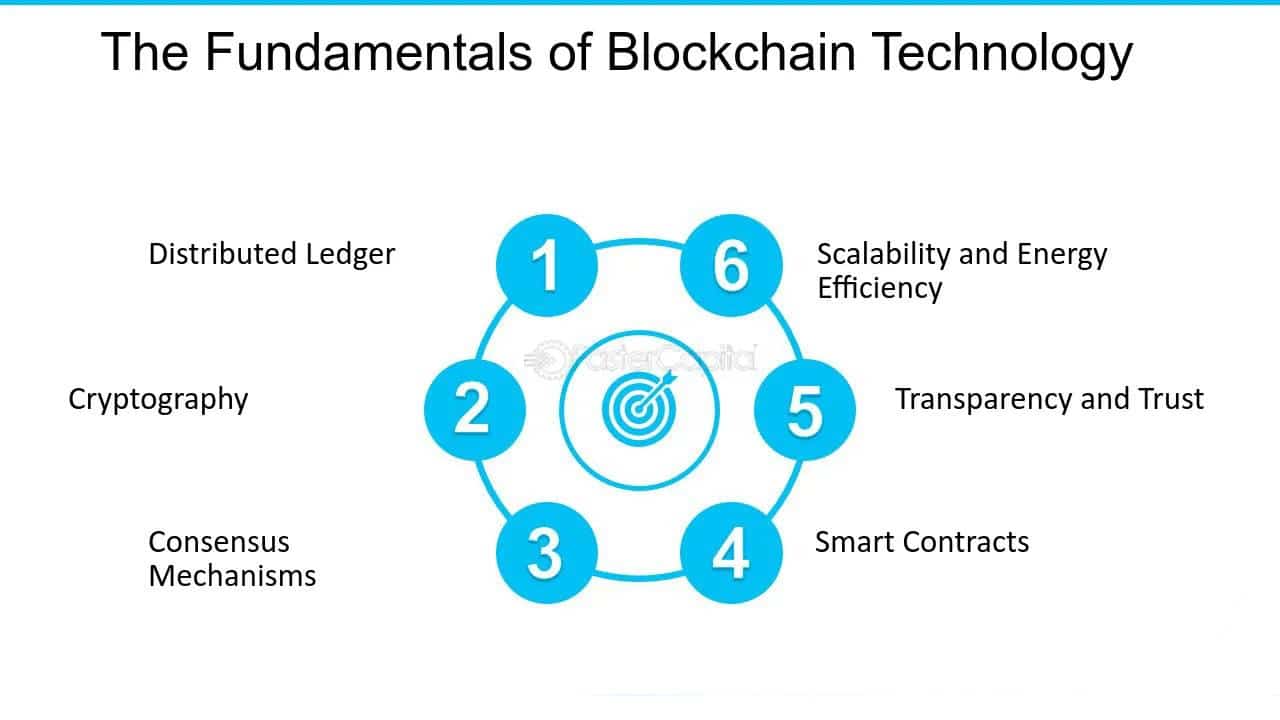

1. Understanding Blockchain

1.1. The general definition:

Many of us know about ‘blockchain’ as this magical data storing mechanism where nothing can be lost, nothing can be hacked, and nothing can be wrong.

Well, we are close. Just not there yet.

So, what is Blockchain? Technically speaking, Blockchain is ‘a database, shared across a public or private computing network’. But simplistically speaking, imagen a series of blocks that link together in a chain. The chain is the network. Each block stands for a computer in that network. They also have ‘hash’ – their digital fingerprint. Every data transfer from one block to another is attached with the hash of the sender.

Now, the main thing that differencing Blockchain from a traditional database is the set of rules applied in the process of putting data into the database. Every piece of information, once uploaded, will be validated by a list of consensus protocol. Then, it will be mathematically encrypted, attached with the hash and added as a new ‘block’ to the ‘chain’. This creates a continuous chronical record and hence, displays the selling points of Blockchain.

First, the new data cannot be in conflict with another existing data in the historical record. Secondary, data can only be added, not remove or change. Thirdly, the data is attached with a hash – which always points to the owner and past owners in the chain. And lastly, it is decentralized. No single authority will be able to take away an asset and change “history” to suit their need. That is unless an authority can control 50% of the network-computing power and rewrite all previous transactions.

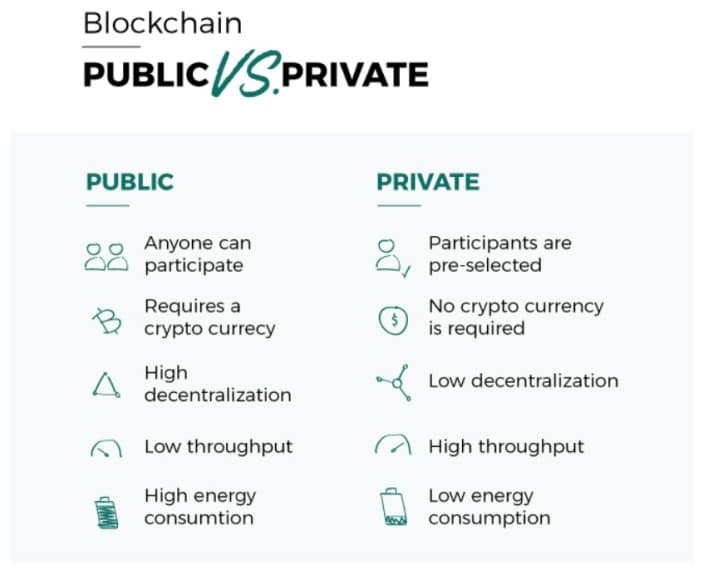

1.2. Types of Blockchain:

There are four types of Blockchain, divided by 4 blockchain – architecture options: Private vs Public; Permissionless vs Permissioned. Generally speaking, the Permissioned-Private option carries the highest possibility to be commercialized due to its nature of high security and lower capital investment.

2. Applications of Blockchain in Healthcare:

2.1 The opportunities:

Base on the advantages mentioned, Blockchain should not be applied only in cryptocurrency. This technology now has great powers and therefore, great responsibilities in the development of modern civilization.

According to McKinsey, in a bird-eye view, Blockchain can help in 2 manners:

a) Record keeping: Storage of static information

b) Transaction: Registry of tradeable information

In application to the healthcare industry, Blockchain can either revolutionize or at least improve the ways things are being handled, which in turns creates substantial values for both the business and the people.

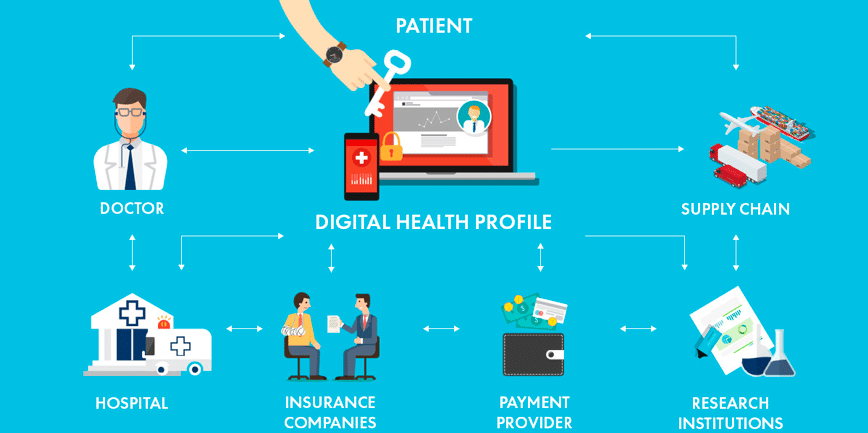

We have come up with several examples for the potential application of Blockchain in Healthcare:

-

-

- Electronic health record: One’s electronic health record contained not only the health-related data but also citizen ID, personal description, and payment address. Hence, it is an ideal target for identity theft. In fact, just 4 days ago, 1.5 million health records of the Singapore citizens got hacked and stolen – including Prime Minister Lee Hsien Loong.

To prevent this situation, Blockchain in healthcare can monitor the accounts that gain access to the data in real time, making sure that every suspicious action is noticed and alarmed as soon as possible. In addition, blockchain can also give patients the ability to set different privacy settings on their medical information by breaking down records into components and granting access piece by piece. This will help to reduce the risk of over-privileging any potential recipient and enhance administrative efficiency. - Healthcare research: While most Blockchain in healthcare is safer to be built on a private server for the sake of security, healthcare research is likely to yield a higher level of social value with the public server. On one hand, using Blockchain, a clinical trial researcher or investigator could search candidates based on specific genetic, demographic, and geographic criteria without even knowing the patient’s name. On the other, by applying the rules of smart contract, patients could even charge pharmaceutical companies to access or use their data in drug research.

- Health Tracking: When combining Blockchain technology with IoT and medical devices, information about the wearer could be stored in a shared ledger accessible by other systems to automate maintenance and management of the wearer’s information. This is practically useful for people with chronic illness on are under end-of-life care.

- Payments infrastructure: The current payment infrastructure is mostly based on relies on file exchange between multiple parties which lead to a longer time to process and larger probability for error. With the power of blockchain, all parties in a financial trade can be connected – allowing faster processing while still ensure the audit trail. It is also impossible to manipulate data, hence limit security breach. Buyers of pharmaceutical will no longer need to depend on bank statements to reconcile their accounting ledgers.

- Drug supply chain: There is in-built vulnerabilities in the drug supply chain at many points on their way to patients, and pharma manufacturers and other stakeholders have little visibility to track the authenticity of products. Blockchain could provide significant benefits here, with barcode-tagged drugs scanned and entered into secure digital blocks whenever they change hands. This ongoing real-time record could be viewed anytime by authorized parties and even patients at the far end of the supply chain. Blockchain in healthcare can also be combined with IoT sensors to ensure the integrity of the cold chain for drugs, blood, and organs.

- Healthcare insurance: The healthcare insurance industry suffers from some major bad reputations, with one of the most prominent complain lies around insurance claims stagnant. With blockchain, organizations can speed up this process by having records posted to a private blockchain, reducing the need for transmitting the data from one host to another.

- Electronic health record: One’s electronic health record contained not only the health-related data but also citizen ID, personal description, and payment address. Hence, it is an ideal target for identity theft. In fact, just 4 days ago, 1.5 million health records of the Singapore citizens got hacked and stolen – including Prime Minister Lee Hsien Loong.

-

2.2 The difficulties:

The organization leaders always need to be a rational dreamer. So, as we have presented the good side of Blockchain in healthcare, here is the not-so-fun side: Blockchain is still more than five years away from feasibility at scale. Here’s why:

Based on the McKinsey’s model, there are four key factors that determine the level of the feasibility of Blockchain in Healthcare: asset, technology, the standard of regulations, and the ecosystem. Applying this 4 factors in the Healthcare industry for evaluation:

-

-

- Asset – Medium feasibility: Asset type determines the feasibility of improving record keeping or transacting via blockchain. Most will need to be digitization. With assets like healthcare record, which are digitally recorded and exchanged healthcare enterprises, can be simply managed end to end on a blockchain system. However, connecting and securing physical goods to a blockchain – for example, at-home health tracking devices – requires enabling technologies like IoT and biometrics. This connection can be a vulnerability in the security because while the blockchain record might be immutable, the physical item or IoT sensor can still be tampered with.

- Technology – Low feasibility: The immaturity of blockchain technology is a limitation to its current viability across any industries. Applying this kind of technology definitely demands a strong series of computer, high 24/7 energy consumption and fast connection speed. With healthcare enterprise which tends to run on an “off chain” database, the switching costs are high. In fact, most cost benefits will not be realized until old systems are decommissioned. Organizations also need a trusted solution provider. Currently, few start-ups have sufficient credibility and technology stability for government or industry deployment at scale.

- Standard of regulations – Low feasibility: The lack of common standards and clear regulations is a major limitation on blockchain applications. With healthcare, since medical data is a sensitive information with a high level of concern, regulations are of course stricter than most industries. For example, in the United States of America, HIPAA rules have multiple subchapters and healthcare entities are going to have to master them all for blockchain.

- The co-opetition paradox – Low feasibility: Blockchain’s biggest advantage lies in the network effect, but that advantages will be limited by the coordination complexity. To apply Blockchain in Healthcare, natural competitors need to cooperate, making sure that their data is correct, transferable and adaptable to the others system. The issue is agreeing on the governance decisions. Overcoming this issue often requires a credible sponsor, such as a regulator or industry body, to take the lead.

-

3. Pieces of Advice with Blockchain in Healthcare

To sum up. there are a plethora of use cases for Blockchain in healthcare, so, companies will definitely face some difficult tasks when deciding which opportunities to pursue. We want to help, and therefore, would love to provide you with a very general but useful step-by-step process:

Step 1: Investigating the true “pain points” — the frictions for customer experiences that blockchain could eliminate.

Step 2: Extensively analyzing the potential commercial value within the constraints of the overall feasibility of the blockchain solution. Considering the overall industry characteristics and regulation as well as a company’s expertise and capabilities.

Step 3: Brainstorming the company’s optimal strategic approach to Blockchain. This step will fundamentally be defined by two market factors:

1. Market dominance – the ability of a player to influence the key parties of a use case.

2. Standardization and regulatory barriers – the requirement for regulatory approvals or coordination on standards.

____

Savvycom has been a long time friend of the healthcare industry, considered our contribution in many projects such as Jio Health and Eva Diary. Recently, we also played a part in the creation of Consentium – the first blockchain-based crypto wallet and community app that reward for user engagement.

Now, our talented developers are looking for a chance to combine our knowledge in the healthcare applications and Blockchain technology to support SME that are particularly interested in being one of the pioneers in this industry revolutionary movement.

Savvycom – Your Trusted Tech Partner!

Leveraging over 25 years of expertise, Savvycom has utilized digital technology to facilitate the growth of businesses spanning diverse industries. Our offerings range from top-notch technology consulting and comprehensive product development to software development consultancy, all aimed at optimizing your business potential. This underscores our commitment to delivering exceptional software outsourcing services tailored to your needs.

Savvycom is what you need. Contact us now for more consultation:

- Phone: +84 24 3202 9222

- Hotline: +84 352 287 866 (VN)

- Email: contact@savvycomsoftware.com

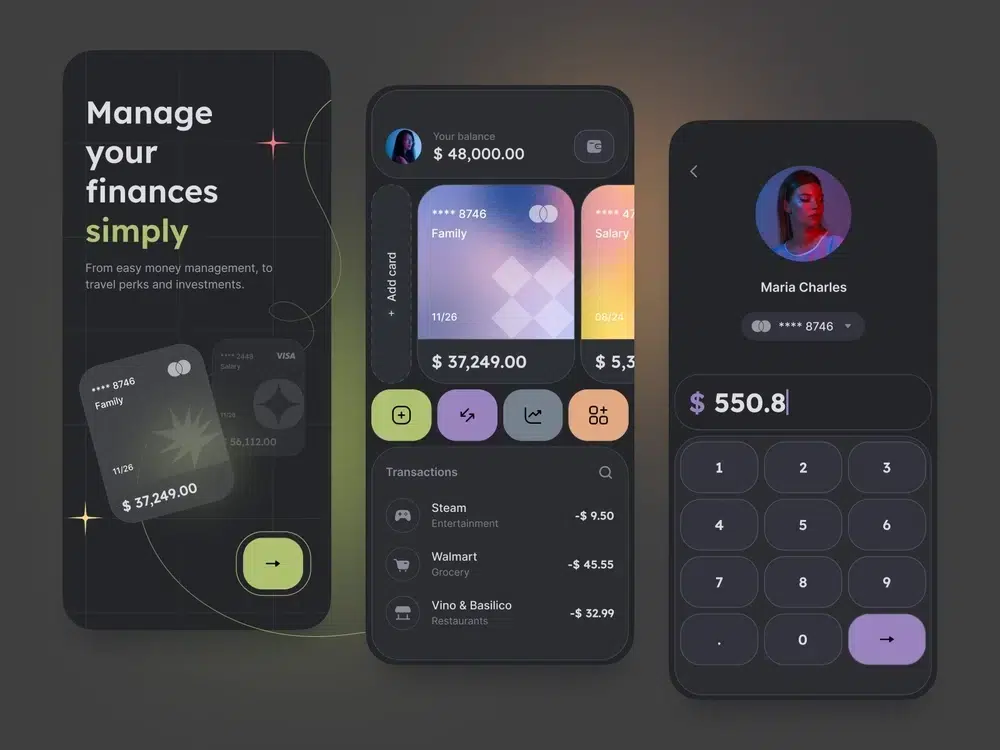

Nowadays, with just a tap of your finger in mobile banking software, you can make your life a lot easier. In this article, we will guide you through Mobile Banking Application Development. Everything that you need to know before starting your project in a Mobile Banking App.

1. What Is A Banking App?

A banking app is a mobile app where you can access your bank account’s details and complete transactions directly from your phone, tablet, or mobile device. Based on the bank you’re accessing, you’ll be able to complete a variety of actions via your banking app.

Most banking apps allow you to view your current balance and transaction history; deposit checks up to a specific dollar value. Another thing you can do is to initiate transfers to other bank accounts, schedule payments or pay your bills, send person-to-person payments, and locate ATMs that are free for you to use.

Learn More On: The Essential Guide To Software Development Services

2. Why You Should Build A Mobile Banking App?

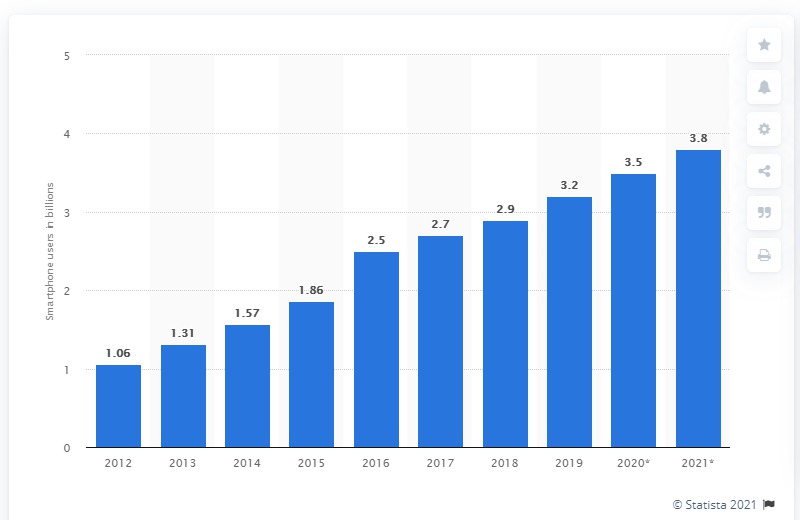

Imagine that almost one-third (32%) of the global population utilizes mobile banking software. Mobile Banking App is something that you cannot miss on your phone and here are the reason why:

-

- In January 2023, mobile devices excluding tablets accounted for nearly 57% of web page views worldwide. – Statista

- The worldwide number of mobile internet users is expected to rise by 908.4 million (+17.4%) between 2023 and 2028. – Statista

- 6 out of 10 mobile users prefer mobile apps over mobile websites and other platforms for account management. – Thinkwithgoogle

- According to latest research, 90% of individuals use mobile banking apps to check their account balance, and 79% use mobile banking apps to monitor recent transactions. – Statista

3. Benefits & Advantages of Mobile Banking Application Development

The benefits of banking app development are mutual:

- Customers benefit from such applications since they provide ease, simple access to a bank account, security, and a slew of other valuable features, which we’ll go over next.

- Having a mobile app means lower staff costs, lower operational costs, and even going paperless, which is more environmentally friendly.

Let’s take a deeper look at the top business perks.

Reduced expenses

Banks save a lot of money by using mobile apps. Here’s how it’s done:

- Expand your coverage. Your company is not bound by branches, regional centers, and so forth.

- Handle heavy workloads. Requests cannot be processed 24 hours a day, seven days a week. They eventually weary and make mistakes, but automation does not have this problem.

- Increased precision. Human mistakes and operational risks are decreasing.

- Reduce the cost of customer service. You require fewer personnel and do not need to rent an office space or incur other connected costs.

Mobile transactions, for example, are 10 times less expensive than ATM transactions, costing only 0.08 cents apiece. In comparison, an ATM transaction costs 0.85 cents while a branch transaction costs $4.00.

Improved customer experience

Mobile apps simply provide more benefits to clients. They’re more secure and convenient: you can’t use fingerprint login with a chatbot or keep a PC in your pocket. Remember that 6 out of 10 people prefer using a mobile banking app over a mobile banking website.

Furthermore, mobile banking app development enables on-the-go 24/7 access to all banking services. Constant accessibility saves time. For example, you may monitor deposits, see recent transactions, schedule bill payments, and so forth, whether at home or when abroad.

Higher return on investment (ROI)

To make a mobile banking app concept a reality, much market research, time, money, and resources are required. Every company anticipates a positive return on their investment in the creation of a mobile banking app.

A mobile banking app owner might anticipate outcomes in a variety of ways. It might be in the form of higher user involvement, a larger customer base, increased revenues, or enhanced market reputation.

There are various case studies of top financial organizations that have seen excellent benefits from building and using mobile banking apps into their procedures.

Better security

Customers’ security is one of the top priorities. Both internet and mobile banking have their own set of vulnerabilities, but added hardware security makes mobile banking more safe than online banking.

Banks utilize gesture patterns and biometric data such as fingerprint and retina scans in addition to standard passwords and two-factor authentication to maximize security. Almost all financial institutions employ encryption to safeguard financial information and privacy, ensuring worry-free mobile banking. Furthermore, because of the proliferation of platforms, malware is less likely to threaten an app. Even if your consumer loses their phone, their financial information is secure.

Additional Revenue Streams

According to Fiserv, mobile banking apps boost return on investment in a variety of ways. According to the survey, banks might see a 72% increase in income from mobile banking users when compared to clients who solely use branches. Customers are also more likely to raise the quantity and value of their debit and credit card, ATM, and ACH transactions after three months of utilizing mobile banking apps.

Banks may increase income with mobile apps by incorporating value-added offerings such as lending, insurance, or BNPL.

Advanced data analytics

Continuous data collection can yield fantastic outcomes. Using advanced data analytics in customer care, sales, and marketing may assist create individualized product offerings that appeal to individuals individually at certain moments.

Furthermore, intelligent data management and analytics provide businesses with valuable insights into their customers’ problems and needs, allowing them to resolve them more accurately and quickly.

Better user engagement and retainment

Push and in-app notifications provide several advantages to you and your users. They educate clients about appropriate offers and discounts, as well as higher credit limits or interest rate information.

Banks who have already put this option in place have a competitive edge over other financial institutions. For example, BNP Paribas reports that after implementing targeted push and in-app alerts, the bank’s App Store rating increased by 60%.

In short, mobile Banking Application Development provides valuable advantages for both the bank and the client.

4. Mobile Banking Development Trends

To get the best outcome from mobile banking application development, let’s examine the current market tendencies, what customers demand from banking software.

4.1. Mobile Banking Trends

Removal of ATM cards for cash withdrawal

Cardless ATM withdrawals are one of the most popular next developments in mobile banking. This function has already been added to several banks’ ATMs.

Debit cards won’t be required going forward if this functionality is used. Users will be able to log onto their bank accounts and complete transactions using the Banking app. Around 70,000 banks will eventually allow cardless withdrawals in the US, according to a Small Business Trends survey.

Growth of Biometric authentication

The mobile banking future is concentrating on increasing the use of biometric authentication in mobile apps to protect your financial information and bank balance. Many banking apps have begun to implement these mobile banking trends 2023.

Instead of PINs or passwords, customers are expected to check in to the banking app using their fingerprint via the smartphone’s touchpad. However, it will also necessitate the use of fingerprint-compatible devices.

AI-powered customer service

The application of artificial intelligence (AI) is one of the most recent advancements in mobile banking. Many financial services have begun to use Artificial Intelligence to answer to enquiries more quickly.

Furthermore, these AI-powered chatbots are intelligent enough to answer basic financial questions.

Voice banking facility

Voice commands are now a part of the current mobile banking trends, which answers the question, Will mobile technology affect the future of the banking industry?

Voice commands are being used as instructions to conduct app operations by banks utilizing technologies such as Google. Furthermore, voice commands can be used to add an extra layer of security. If activated, users will be required to use their voice to gain access to the information protected within their banking app.

A-B-C-D verification process

One of the most promising future mobile banking developments will be seamless Know Your Customer (KYC) verification. ABCD stands for artificial intelligence, blockchain security, cloud space, and data. Banking applications will acquire certain types of personal information throughout this procedure, such as transactions, ID, utility bills, and so on.

Furthermore, the data will be secured in a blockchain-protected cloud space. Finally, AI will provide a report on the user’s eligibility for loans and other financial services.

Digital-Only Banks and Blockchain

Banks with no network/no brick-and-mortar branches are becoming increasingly popular. Virtual banks focus on cloud-based infrastructure and the benefits given by digital networks. These characteristics make current online banking systems ideal for blockchain deployment. This technology enables untrusted parties to reach an agreement on the status of a database without the use of an intermediary. Blockchain enables the provision of numerous financial services without the involvement of banks.

4.2. Target Audience of Mobile Banking Development

Nowadays, smartphones have become more accessible in almost every part of the world, thanks to low-cost budget phone series even from the most popular vendor like Apple with their iPhone XR or Samsung with their Samsung Galaxy A Series. These markets have started to invest heavily in mobile banking development.

The markets in Asia and Africa have had a boost of 50% among the inhabitants who utilize banking applications. The McKinsey mentioned above study notes that even impoverished people in the Philippines showed a surprisingly high interest in mobile banking technology.

These days, the highest growth in acceptance of modern banking can be observed in emerging markets, namely:

- Southeast Asia – The number of users of digital banking has doubled over the past three years here. Countries like Malaysia, Singapore, Cambodia, Laos, the Philippines, and Vietnam, and Indonesia will adopt more mobile banking services in the nearest future.

- Latin America – The market has not yet exploited the advantages of mobile banking. Banks have only just begun to digitize their services. The number of banking apps users is predicted to account for 47% of the population in 2019.

- Eastern Europe – The most adoptive market of financial mobile applications currently, and this trend is still growing.

Looking For a Trusted Tech Partner?

We’ll help you decide on next steps, explain how the development process is organized, and provide you with a free project estimate.

The latest research points out that the current target for banking apps is the tech-savvy millennials. The generation most interested in digital banking is millennials (79.3%), while baby boomers are the least interested (33.8%).

So, what do users expect from mobile banking application development? According to a report from Statista, the most common operations performed with apps for banking are as follows:

- 90% of users check their account balance

- 79% to view recent transactions

- 59% to make bill payments

- 57% to transfer funds

- 20% to contact customer service

- 19% to open a new account

- 17% to reorder check

All in all, by 2020, the number of clients engaging with apps for banking increased to over 2 billion. This means that the financial sector has undergone changes characterized by reducing human interactions like visiting a branch or contacting a call center.

And with the recent development regarding Covid-19 and the global pandemic, people are more likely to find alternative method like banking app rather than going to a branch. For instance, all iOS, Android, and other mobile banking apps maintained around 15% to 20% monthly interactions, with a monthly response rate of 80% to 94% across the three main sub-industries.

4.3. Best Banking Apps of 2023

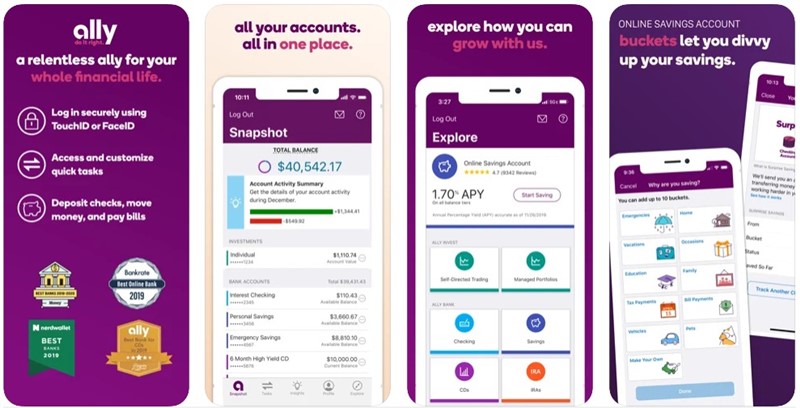

Ally Mobile puts everyday banking and investing tasks at your fingertips.

So what is now considered a cutting-edge mobile banking application? Some apps let you track accounts from different financial institutions. Others offer built-in financial wellness and budgeting platforms. Some even turn your mobile device into a digital wallet.

It’s an exciting time in the world of mobile banking, and if mobile offerings are a deciding factor for you in choosing a bank, we’ve assembled this list of the best banking apps.

- Ally Bank: Best Online Mobile Banking App

- Capital One: Best Mobile Banking App in Customer Service

- Bank of America: Best Mobile Banking App for Security

- Varo: Best Mobile Banking App for Money Management

- Wells Fargo: Best Mobile Banking App for Monitoring Investments

- Chase: Best Mobile Banking App for Prepaid Cards

- Chime: Best Mobile Banking App User Experience

- Discover: Best Mobile Banking App for Rewards

- PNC Bank: Best Mobile Banking App for Cardless Purchases

- Synchrony Bank: Best Mobile Banking App for Managing Multiple Accounts

5. Functionalities for Mobile Banking Application Development

Main Mobile Banking Features

For efficient mobile banking application development, most users (86%) are interested in two features – checking balances and exchanging funds between accounts.

5.1. Essential Features of Mobile Banking

The general features used in mobile banking development that are hard-to-avoid are as follows:

- Account creation

It is imperative to build a secure and quick authorization process. Multi-factor authentication is a safe sign-in option but takes some time to fill in the necessary information.

Alternatively, biometric authentication using physical user metrics (appearance, voice, even gestures) is far quicker and even fun.

A MasterCard study indicates that users have become more willing to use personal biometrics as their passwords. The Wells Fargo app has a verification feature that scans the iris of their corporate customers.

- Account management

This point may include a range of mobile banking features. Users can check their cards, bank accounts, review account balance and record history, etc.

It is even possible to implement some additional functionality. For instance, the ABN AMRO Bank in the Netherlands included a unique mobile banking feature for personalized account management.

This feature allows users to set a savings goal, create investment plans, and perform repeat payments.

- Bill payments

Users have the option to schedule one-time or monthly payments within the app, pay when notified through email or push notification, or both. Alerts, for instance, will work well if customers deal with utility bills and variable amounts. While fixed payments like mortgages benefit greatly from recurrent payments.

UI/UX designers will likely break this action down into several steps if there are numerous information or large forms to fill out. By doing this, the procedure is less intimidating than filling out a huge form all at once.

- Customer support

Although automation is the main focus of banking app development, some human assistance is still required. Staff support or additional verification may be needed for some operations. When you need to adjust your credit card limit or unblock a card, for instance.

Users need to be able to speak with a bank representative or a personal manager, submit requests, and get their questions answered. If your customer service crew isn’t available around-the-clock, you may at least include a FAQ section or deploy an AI-powered chatbot.

Learn More On: Fitness App Development: Features, Trends and Costs

- ATM & bank branch locations

Mobile Banking Application Development should not skip this fundamental feature of mobile banking services. In order to improve the user experience, it is possible to apply VR technology. This is a unique feature of mobile banking implemented by RBC. It allowed the bank to increase the number of its app downloads tremendously.

- Secure payments and transactions

P2P transactions, payments for services, and fund exchanges should be processed securely and conducted anytime and anywhere with the help of a banking app.

An alternative variant of this feature in mobile banking application development is using QR codes for goods and services payments. Scanning QR codes is a fast and easy way to conduct these operations inside the app. Only a few banks have offered this mobile banking feature to their clients.

- Push notifications

Mobile banking application development should utilize reminders and alerts to increase customer engagement and app promotion. It is necessary to control this aspect and plan the communication strategy with your client in advance because most users would not appreciate receiving intrusive notifications.

5.2. Extra Mobile Banking Features

Enhance your application with these features

The app features mentioned earlier create the core of mobile banking application development. To increase user traction and interest, you should be thinking about some innovative mobile banking features which might ultimately be the deciding factor of your app likes:

- Spending trackers

Mobile banking development should focus on user needs, even if they are not explicit. This functionality can control personal budgets and set some goals for desired purchases. The system can create a customized dashboard based on user information, give necessary motivation, and inform users regarding progress.

Alternatively, users can set some scheduled payments and bills in advance not to miss an important transaction. This mobile banking feature is utilized in a significant way in the Simple App. The app is used to track spending habits, plan budgets, and save on each expense.

- Cash back service

Cashback means receiving a tiny percentage of the money spent by customers. Many banking apps offer automatic payback on numerous brands or services such as entertainment, shopping, and car maintenance.

- Personalized offers

It makes sense to create special offers, discounts, or coupons with a mobile banking app. The opportunity lies in partnering with restaurants, cafes, coffee houses, and so on for the provision of particular discounts or coupons. This feature stimulates sales and, at the same time, engages the user with your mobile banking software.

- QR code scanner

In 2020, more than 27% of respondents in the United States and the United Kingdom utilized a QR code as a payment option. And this feature has become increasingly for banking apps in Asia as the result of the advancement in payment method.

QR payments are secure because of their distinctive design and are simple to set up: all consumers need is a smartphone with a camera and a QR code to read.

- Money converter

The number of tech-savvy foreign exchange companies is rapidly increasing, and banks must stay up. Some banking apps only display in-app exchange rates, whilst others go the extra mile and include a full-fledged in-app converter.

For example, combining multi-currency spending and money transfers in a simple app is what made the Revolut app popular.

- Apps for smartwatches

Although just a few banks provide wearable apps, smartwatches continue to be the most popular wearable gadget. Offering such could provide you a competitive edge.

The first banking app for smartwatches was developed by the Australian Bank of Melbourne. Customers might use their smartwatch to pay for goods and services, receive push notifications, check their balance, and locate the closest ATM.

Mobile Banking App Made Easy With Savvycom

Reach out to Savvycom for complimentary software development services consultation. We’ll assist you in determining the next course of action, elucidate the organization of the development process, and furnish you with a no-cost project estimate.

- Unique services

Mobile banking application development can include other non-traditional services. These services can consist of purchasing tickets, ordering a taxi, reserving a table, delivery, and more.

For example, a Polish bank (Zachodni WBK) reached out to new users with the functionality of paying for public transport, shopping, and taxi-hailing directly from its mobile app.

- Finance sharing feature

Visa research indicates that to attract millennials, it makes sense to concentrate on mobile banking application development for budgeting. This mobile banking app may include sharing finances and splitting bills.

For instance, the app from Emirates NBD has a bill-splitting feature where each user has to include some sum and indicate the number of people participating in the operation via social networks.

Final recommendation: It is better to develop a couple of apps with distinct mobile banking features rather than complex software with lots of operations, details, and data. Try to ask your target users about their priorities in banking procedures and focus on providing a solution for them first.

6. Mobile Banking Application Development Processes

6.1. Conduct Research And Make A Plan

The preliminary stage is crucial and shouldn’t be skipped at any cost. The first task is to conduct market research. You need to identify your competitors, check alternative solutions on the market, and learn what is popular among the crowd. Without doing this, you may go in the wrong direction.

Once you’ve got the research results, continue with defining your target audience. Your application may be for corporate clients, families, individuals, or institutions. Knowing your clientele will help you find out their pain points, which are crucial for sketching an app toolkit.

In this step, you should make a detailed plan for mobile banking development, including expenditure projections that will become a foundation for your budget.

6.2. Create A Prototype

A mobile app prototype demonstrates how a product will function

Every Application starts with an idea in your mind. To turn it into reality, you need to create a sketch or prototype explaining in general terms the structure and order of design elements, visuals, and content. You may start with low-fidelity wireframing to sketch a home screen, users’ accounts, personal dashboards, and the layout for a landing page.

As a rule, wireframes consist of boxes, lines, and texts made in the white and black color scheme. You can use an app wireframe to validate your concept and collect early feedback. Next, you can turn your wireframe into a hi-fi prototype that will include a graphic presentation of a product, layout, interface components, the color scheme, and micro-interactions.

Just like wireframes, use your app prototype to demonstrate its toolkit to your focus group, test functionality, and interface. You can add default texts, placeholders, and test data so that people can feel how your app works.

6.3. Make A Graphic Design

Be ready for hard work in this step as your app’s design is its business card that should be recognizable. There are tons of tips on how to make a perfect design for a mobile application. We have created a shortlist of essential recommendations. Check them below.

- make sure that typography, icons, color palette, buttons, and forms of your solution match your corporate style and brand;

- the navigation should reflect the logical architecture of your solution;

- all the design elements – buttons, links, forms, icons – should be clear and comprehensive;

- choose colors, images, video files that evoke certain emotions and feelings;

- consider cultural differences if you’re going to operate globally;

- adjust your app to iOS and Android standards to efficiently market it earlier on;

- your app icon should be unique and make your solution stand out;

- think about extra bells and whistles like sticker packs for messengers.

Learn More On: All You Need To Know About Telemedicine App Development

6.4. Choose A Technology Stack

When choosing a technology stack for your Mobile Banking App, you should concentrate on four areas: front-end, back-end, cross-platform frameworks, and other prerequisites such as robustness and security. Make a checklist that would include the following criteria